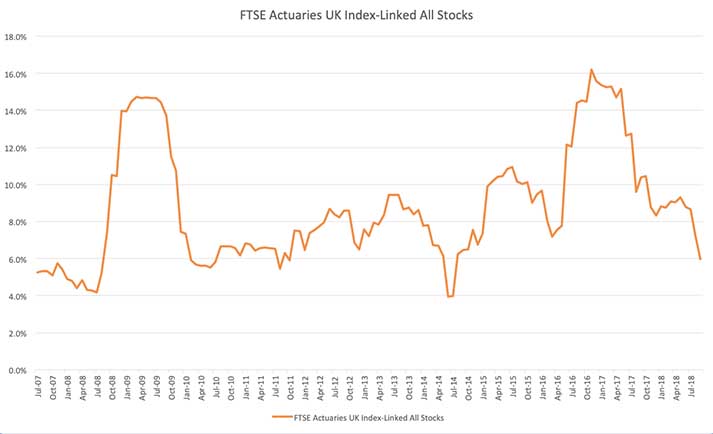

Financial advisers are understandably running scared of the conventional gilt market. Instead many have turned to the indexed linked market seeking safety from growing global inflationary risks. For me this is liking watching the victims of a horror film trying to scramble away only to place themselves in ever greater mortal danger. The index linked gilt market has a scary duration that leaves it extraordinarily sensitive to changes in real interest rates. The chart demonstrates quite how violently this can manifest itself, with the volatility at times approaching 16% - levels normally associated with equities. As real interest rates have been closely correlated with nominal rates, investors should make sure that they are not instead turning deeper into the lair of Jason Voorhees…

Source: Square Mile as at October 2018