RSMR

Free tips and help

Call Us: 020 3004 4479

Email: enquiries@adviser-hub.co.uk

How Share Buybacks can boost Returns

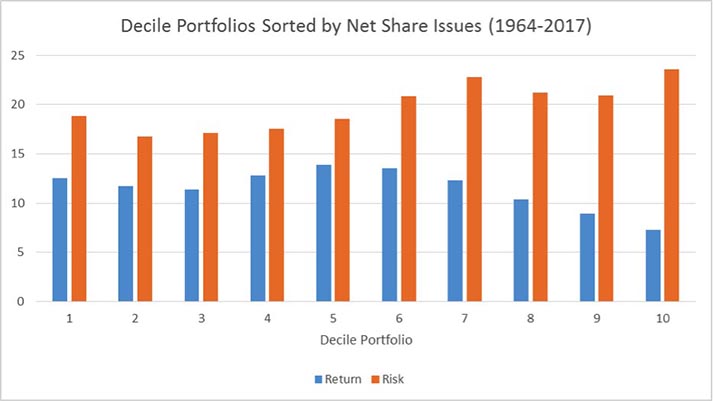

Companies regularly change their total amount of shares-in-issue through new share issuances or share buybacks. This month, we examine if changes in shares-in-issue have an impact on future returns. We sort of stocks by shares-in-issue and show that stocks with the largest annual increase also have the worst returns and risk. Companies with the lowest change in shares-in-issue appear to be high quality firms and have good defensive properties.

Key Issues this month:

- Shares with the greatest increase in shares-in-issue have the lowest annual returns of only 7.3% per annum.

- The same high issuance shares have the highest standard deviation of annual returns at 23.6% per annum.

- Shares with low net-issues tend to be high-quality companies, which provide good downside protection in market corrections.

Factor Risk & Returns

A listed company can change the number of shares it has issued in the market, principally with new share issues or share buybacks. The new issuance of shares increases the number of shares in circulation, whereas during buybacks, companies use some of their cash reserves to reduce the number of shares in circulation. In theory, the share price should immediately react to changes in shares outstanding and there should be no impact in subsequent share price returns. This month, we explore if changes in shares-in-issue leads to predictability in future share price returns.

Table 1: Data taken from Ken R French Data Library

The graph above shows decile portfolios of US stocks sorted by net share issues. Net-share-issues are calculated by the change in shares outstanding over the past year. Decile portfolio 1 has the smallest change in net-shares over the prior year and decile portfolio 10 the largest. Annual returns are shown by the blue bars and annual risk, in the form of standard deviation, is shown by the orange bars.

“There appears tone a return penalty for shares with a large increase in shares outstanding”

In terms of returns, the first 7 decile portfolios have annual returns in the 11-13% per annum range, but there is then a drop in annual returns, with decile portfolio 10 having the lowest return of 7.3%. In terms of risk, represented by the orange bars, decile portfolio 10 has the highest standard deviation of 23.6% per annum. In summary, there appears to be a return penalty for shares with a large increase in shares outstanding, with companies in decile portfolio 10 having by far the lowest return. These same shares also have the highest volatility of returns, which makes them unattractive to investors.

Factor Correlations

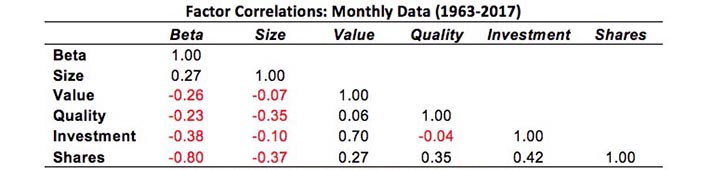

The risk-return properties of a net-share-issuance factor look attractive, but would it combine well with other factors? The chart below shows the correlations for different factors commonly used in smart beta products. Each market neutral factor is calculated using monthly data, with the net-issuance factor shown in the Shares row.

Table 2: Data taken from Ken R French Data Library

The correlation table shows that the shares-in-issue factor has a negative correlation with market beta and size factors, but a positive correlation with the other factors: value, quality and investment. The high correlations with quality and investment factors are not surprising, as we would expect high-quality companies, with conservative investment policies, to issue fewer shares.

The shares factor has a very low correlation with the beta factor, which suggests that it provides strong protection in market downturns. Looking at the last 3 major falls in the equity market in 1990, 2000 and 2008, shares with low net issues have provided good downside protection. For example, a market neutral strategy within the Shares factor, investing in the bottom 3 Shares deciles and shorting the top 3 Shares deciles, would have returned +10% in 2008.

Conclusion

This month, we examined the net shares-in-issue factor and found that it has appealing risk-return characteristics for investors. The premium appears to be driven by a penalty for investing in stocks with a large increase in shares-in-issue. These stocks have low annual returns, combined with high risk, which is an unattractive combination. We also found that a net-share-in-issue factor has good correlation properties with the other factors. The factor is related to the quality and low-investment factors, which suggests it has very good defensive properties and we showed that low net shares-in-issue companies would have provided some protection during previous market crashes.

Chris Riley, RSMR, October 2018

Latest News

UPCOMING EVENTS

Get In Touch

Find Us On Map

Weekly Market Updates

Latest Business News

Keep up to date with financial market notifications & advice to further your business opportunities