- enquiries@adviser-hub.co.uk

-

Aberdeen Investments

Aberdeen Investments

Aberdeen Investments is a global specialist asset manager with a proud Scottish heritage. For over a century, our Scottish spirit has been the driving force behind our success. Our sense of adventure has led us to new markets, our courage to invest when others haven't has unlocked global opportunities, and our resilience through challenging markets has formed the foundation of our long-term strategy.

We are dedicated to helping investors achieve their financial goals in a changing world by combining our specialist knowledge, global presence in more than 25 locations, our strong relationships, and investing for the long term. As of March 2025, we manage £359.6bn of assets. Clients know us for our expertise in Asia and emerging markets, specialist equities, real assets, and both public and private credit. Our solutions include investing for the needs of insurers and pension providers; managed portfolios; enhanced index and quant investing.

Central to our strategy is a firm commitment to environmental, social, and governance (ESG) principles. To that end, we promote sustainable investment practices through active ownership and our unique and embedded team structure, ensuring sustainability expertise is located where it is needed.

Our focus is aligned with four pivotal themes shaping the future of investing: the democratisation of finance and digital innovation; the evolving needs of ageing populations; the development of Asia and emerging markets; and climate change and the energy transition. These ‘mega trends' inform our approach, enabling us to deliver relevant and impactful investment solutions to clients of all sizes, today and into the future.

At Aberdeen Investments, we strive to create investment opportunities for our clients beyond tomorrow.

As at March 2025.

Events

How can investors manage AI and tech concentration risk? Sign up for Aberdeen’s live Macro Outlook 2026 webinar.

Join our MyFolio Q4 Webinar for a macroeconomic outlook and review of the MyFolio Fund ranges.

Join our MyFolio Q2 Webinar next week, for a macroeconomic outlook and review of the MyFolio Fund ranges.

Latest Insights

Geopolitical tension, AI disruption and the arrival of a new Fed chair. What could shape markets next?

A strengthening US economy, shifting geopolitical currents and diverging monetary policy moves characterise the outlook. Understanding these forces will be critical for investors navigating a more fractured, fast-moving world.

With US equities ‘priced for perfection’ and market concentration at historic highs, emerging markets may offer a more balanced path to growth, and a way to reset portfolio risk.

Is 2026 shaping up as the year US small caps reclaim market leadership convincingly?

Discover why the BBB–BB crossover universe has become one of the most compelling areas of global credit — offering high-yield-like income without venturing into the riskiest parts of the market.

Stablecoins promise faster, cheaper and more transparent payments. But can new regulation help the UK — and its financial institutions — capture this opportunity?

Can grounded sustainability drive lasting value and practical change?

EM’s rally has raised big questions – and the real story sits beneath the headlines.

A resilient global cycle continues to support calculated risk taking. Global growth remains solid, inflation is easing, and policy is gradually loosening — all supportive for asset markets, despite the risks.

How does an Enhanced Index strategy manage the risks market cap and equal weight embed?

Aberdeen’s MyFolio Q4 2025 review: diversification with solid foundations.

Aberdeen consider key questions facing the global economy and markets in 2026, including the outlook for US growth and the labour market, monetary policy under the next Fed chair, whether there is an AI bubble that bursts, if China’s anti-involution campaign will raise inflation, and a big year for Latin American politics.

Insights from Aberdeen’s economic research team on navigating 2026’s anticipated economic and geopolitical themes.

Global tensions are rising fast. How will Venezuela’s upheaval and new US tariff threats reshape markets? Discover the key geopolitical shifts driving 2026 in Aberdeen’s latest video.

As global tensions grow attention is shifting from tariffs on goods to restrictions on the flow of money. What would a capital war look like — and who would get hurt?

UK real estate looks set to deliver healthy returns in 2026.

Physical climate risk is no longer a niche concern – it’s a core investment issue. Find out why.

The companies Aberdeen think could be the real gifts under the tree.

See how private markets are evolving to offer resilience and growth in 2026.

Which EMD trends will define 2026? Discover where the strongest opportunities lie, what risks to watch and why active investors may have the edge.

Quant investing harnesses data, technology and disciplined processes to deliver consistent, transparent and adaptable outcomes. Here’s how Aberdeen approach the science behind smarter portfolios.

What are factors? What’s an enhanced index fund? Aberdeen address your questions.

Will AI-driven growth keep global markets rolling, or are new risks on the horizon? Discover key forecasts for the US, China, Europe and Japan in our latest economic outlook.

Will AI drive growth or risk a bubble? Watch our video for our take on 2026’s key global economic trends.

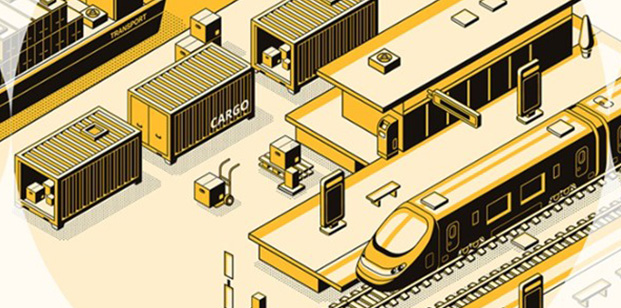

Transport infrastructure is evolving in a world shaped by urbanisation, decarbonisation and digitalisation. Why should investors see transport as a mainstay—and a megatrend—for 2026 and beyond?

Geopolitical tensions, economic fragmentation and shifting asset class correlations are redefining the investment landscape. Understanding these forces is essential for investors seeking resilience and opportunity.

Emerging markets could drive global growth in the years ahead. We explore how investors can rethink equity portfolio strategy in a changing world.

Emerging markets are adapting to Trump’s return, navigating tariffs and volatility. Will resilient economies and high yields create new opportunities for investors in 2026? Discover what’s driving EM debt now.

Pointillist art offers a compelling insight into building resilient portfolios—where each investment plays a role in shaping the whole.

Our Q&A reveals why the fund’s bottom-up approach has stayed true for over 20 years – and what it means for the future.

Can sustainability and performance go hand-in-hand in risk-targeted investing?

Explore how tech giants are driving a surge in bond issuance as AI accelerates – creating new opportunities and risks.

Celebrating 15 years of clarity, confidence, and client-first investing.

Quant investing harnesses data, technology and disciplined processes to deliver consistent, transparent and adaptable outcomes. Here’s how we approach the science behind smarter portfolios.

The key points from our latest quarterly webinar.

Robust rental increases and a shrinking construction pipeline are supporting UK income growth. Read more about our UK real estate outlook.

Rail investment is gaining momentum as transport decarbonisation stalls.

Explore the key Q3 developments across our economic infrastructure portfolio.

Why did this independent research company honour the fund with an award? Find out here.

How are we navigating real estate risks? Read more about Aberdeen’s global framework.

UK advisers and wealth managers are seeking alternatives to cash and liquidity holdings.

The MyFolio Enhanced ESG ranges are designed as a simple, cost-effective way to invest responsibly.

Our fund managers explain how MyFolio supports clients' long-term goals with simplicity at its core.

We aim to invest where real estate will be. Not where it has been.

Discover an active credit strategy with yield potential.

Why is Aberdeen's MyFolio such a trusted adviser solution?

Aberdeen Investments explains how MyFolio supports clients' long-term goals with simplicity at its core.

Find out in this wide-ranging interview with Aberdeen's Global Head of Fixed Income Jonathan Mondillo.

Why is Aberdeen's MyFolio a trusted risk-targeted solution for multi-asset investing?

Is China’s green boom about to go bust? Overcapacity fears loom – but the long-term story may just be beginning. Read more here.

A look into the world of exchange-traded funds and why an actively managed approach is gaining traction with investors.

Emerging markets face a $43 trillion infrastructure challenge. Investors can help bridge the gap and unlock growth, resilience and returns in the process.

Read more about the key achievements across Aberdeen’s portfolio companies in the second quarter of 2025.

Discover how hybrid real estate funds are reshaping access, liquidity, and opportunity.

Renewables are now a strategic imperative. Is your portfolio aligned?

A look at why telecom towers can be an ideal asset for infrastructure equity investors.

Celebrating 10 years of our World Equity Enhanced Index Fund and 20 years of our quants team.

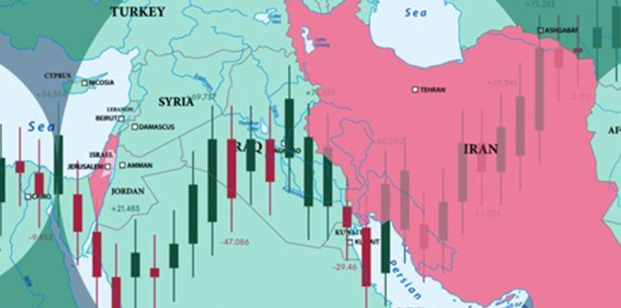

A look at how the Israel-Iran conflict served as a real-time stress test for different equity styles – showing how momentum, value, and quality behave under pressure – so investors should look past labels and understand what truly drives their portfolios.

We explore Europe's focus on resilience, highlighting prospects in securing supply chains and spurring innovation.

Mark Munro and Joyce Bing take stock on the second anniversary of the Short Dated Enhanced Income Fund.

In the latest episode of the Emerging Market Equities podcast, Nick talks with Fraser to discuss his recent trip to the Middle East.

Why alternative investment company discounts represent investment opportunity.

Euro corporate bonds are gaining ground amid fading US exceptionalism and rising hedging costs. Discover why investors around the world are rethinking their bond allocations.

In a world where the old rules no longer apply, how can investors stay ahead? Discover why geopolitics, scenario planning and conviction are now essential to navigating global uncertainty.

Climate risk is breaking supply chains. Are investors asking the right questions? Discover why indirect exposure could cost more – and how resilience creates opportunity.

What’s next for the dollar, private markets, and global portfolios? Aberdeen’s experts share their insights.

Is the dollar’s dominance fading? Discover why we’re backing duration, corporate risk and infrastructure amid rising geopolitical tensions, tariff shifts and global investment realignment.

European small caps are positioned to benefit from US uncertainty. Could this overlooked asset class be the smarter way to invest in Europe right now?

Europe is reindustrialising. Power grids are under pressure. Discover how supply chain resilience is reshaping investment in factories and infrastructure, and why this shift could define the next decade.

Returns have been gradually climbing since the start of the year, as capital growth has returned. Find out more about our UK real estate views.

Can AI replace fund managers? Discover how artificial intelligence could transform investing – and what a leading researcher says about its promise, pitfalls and future.

Aberdeen Investments explain why the Short Dated Enhanced Income strategy could be worth considering for investors looking for a stable ‘step out of cash’ income solution.

What’s the global infrastructure spending megatrend, and what’s in it for investors?

Liam Blaikie considers the influence of the ‘sovereign ceiling’ in EM corporate bond credit ratings.

Investment-grade short-dated bonds have historically offered lower volatility and higher yields than cash. A smart move in uncertain times.

The companies in our strategy seek to deliver real-world decarbonisation & adaptation while providing a financial return. Find out how.

In this new episode, we explore the staggering global infrastructure investment needs over the next 25 years, why the bill is so high, and how governments and private investors might share the load.

Aberdeen’s innovative range has passed a key milestone. What explains its popularity with clients?

While the threat of an escalation in the US trade war has receded, slowing global growth will be a drag, particularly on EMs reliant on trade. That said, a weaker US dollar and limited spillover from rising developed market bond yields should give EM central banks room to support their economies.

Tariff shocks have worn off, but investor concerns are shifting to fiscal risks. Explore what’s driving international economies and markets in our latest analysis.

European defence spending is set to rise. However, fiscal considerations and low growth multipliers will constrain the economic tailwind somewhat, while fractured procurement and reliance on arms imports need to be addressed.

China’s battery maker CATL recently enjoyed a bumper listing. Here, we explore China’s battery dominance and share details of our recent visits to CATL’s cutting-edge factory.

Investors are ready to fall back in love with the telecommunications sector.

We recently visited Milan to meet some of the standout Italian smaller companies – from luxury goods to finance. Here’s what caught our eye.

Our summary of developments in emerging market debt in May 2025 and outlook.

How should investors navigate tariffs, rate cuts and fading US exceptionalism? Explore the latest House View for new insights on equities, bonds, private markets and the global trends shaping the next 12–18 months.

What’s driving the latest surge in US deficit projections? Lizzy Galbraith highlights the fiscal and trade policy shifts that could reshape the global economic outlook.

In this episode, we explore the Trump administration’s sweeping plans that would swell government borrowing, why bond markets are getting nervous, and what Elon Musk’s exit may mean.

We explore the Deeside AD Project's role in the UK's energy transition and decarbonisation efforts.

Most often associated with growth investing, a look at how emerging markets represent a uniquely appealing income universe for today's active investors with a total return mindset.

In this new episode, we unpack the surprise US-China tariff truce, how it may influence other tariff negotiations and whether investors can finally relax.

How might new tariff developments impact the global economy? Paul Diggle provides his latest analysis to help you navigate the constantly shifting terrain.

Both developed and emerging economies need significant infrastructure investments for growth and sustainability. A new model quantifies these needs, emphasizing the necessity of substantial private capital.

Matt Williams, Senior Investment Director on the Global Emerging Markets desk, reports back on some long-term positives for the region.

Demand for ‘future minerals’ vital to the green transition is set to take off. Here’s the why, and how, you should consider playing the start of this new ‘super cycle’.

Kieran Curtis considers the outlook for emerging market local currency bonds amid the US-led global trade war.

Future minerals are critical to the green transition. Even though demand is forecast to snowball there are serious constraints on supply. Here’s why investors should take notice.

Read more about the key achievements across our portfolio companies in the first quarter of 2025.

The Raymond James US Equities Conference is a prime opportunity to engage with companies and investors. Here’s what we discussed this year.

We expect UK real estate to forge ahead despite the headwinds. Read more about our views in our Q2 outlook.

Geopolitics and macro uncertainties are the largest risks to our forecasts. We discuss our outlook for Q2.

As London’s office market faces high vacancy rates and declining values, the focus shifts to connectivity and adaptability.

Our summary of developments in emerging market debt in April 2025 and outlook.

In the latest episode of the Emerging Market Equities podcast, Nick talks with Bob to discuss Trump's first 100 days in office.

Discover why outsourced investment solution MyFolio uses strategic asset allocation.

Aberdeen looks at the unexpected post-“Liberation Day” outperformance of EM and Asian equities – and why they believe the investment case for the asset class remains in place.

Navigating the complexities of tariffs and political uncertainty can be challenging. Gain insights and investment ideas from Aberdeen's experts in the latest Investment Outlook.

Explore how to navigate market concentration and political unpredictability. Ready to diversify your portfolio?

How may Trump's tariffs reshape investing? How are we adjusting our model portfolio? Explore the profound uncertainty and potential damage to the world economy.

Find out how private markets may offer stability and growth in today's volatile world. Can they be an investment haven? Discover the benefits now.

Can this be the end of the road? Discover the transatlantic split and evolving strategies amid the political backlash. How may asset managers adapt?

Our strategy for managing risks and enhancing long-term performance.

Josh Duitz outlines the potential benefits of infrastructure equities in a world of heightened market volatility.

Could the EU's updated performance standards help unlock opportunities?

Our summary of developments in emerging market debt in March 2025 and outlook.

What are factors? What’s an enhanced index fund? We address your questions.

Can investors make cash work harder with a short dated enhanced income strategy?

Discover a cost-efficient quantitative investment strategy with outperformance potential. Find out more with Aberdeen Investments.

Read Aberdeen Investments’ latest article on their changes to the multi-asset range, lower fees, and wider investment options across the universe.

A look at the what, why, how, and when in the US small-cap space and the outlook for the rest of 2025.

Are you an adviser seeking risk-targeted solutions for your clients? Watch and hear about the MyFolio Index.

Real estate fundamentals are supportive in the UK, and we expect income yields and active management to drive returns. Read more about our UK outlook.

We no longer anticipate any further falls in prime European all-property values. We discuss our outlook for European real estate.

In the US, we are most positive about the multifamily sector, as excess supply should be absorbed by mid-2025. We highlight the key real estate themes in our US outlook.

Within APAC, Japan and Korea are the top-two markets where we have the highest conviction. Read more about our APAC real estate outlook.

The global economic landscape is unfolding with a mix of robust growth prospects and looming challenges. We discuss what lies ahead for global real estate.

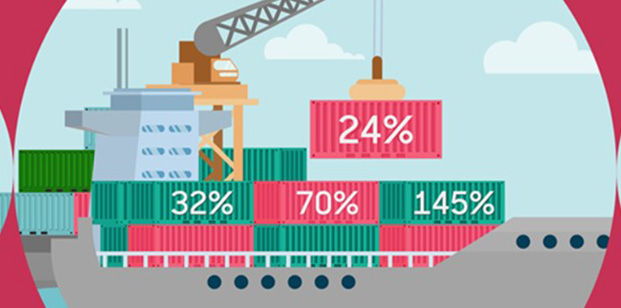

Discover our latest thoughts on US tariff policies and their far-reaching effects on the global economy. How will tariffs shape international trade, growth, interest rates and geopolitics?

Chinese company DeepSeek recently launched its new large language model, creating a seismic shift in the tech world. So, what’s next?

Allows abrdn access to full freedom to invest in internal and external active and passive funds.

abrdn Investments examines what may be in store for the asset class in the new year, including insights, projections, trends, and implications.

abrdn’s Kevin Daly explains why he thinks frontier country bonds should offer more reward than risk in 2025.

abrdn asks: could you contribute to decarbonisation and tap into long-term investment potential?

In the Monthly Macro video for November, Lizzy Galbraith, Political Economist, discusses what Trump’s leadership may mean for taxes, the deficit, immigration, trade, growth and inflation.

As interest rates drop and inflation cools, abrdn assess the most promising segments of the fixed income market.

Listed infrastructure investment companies are trading at significant discounts to NAV. Uncover the reasons and potential opportunities for investors.

abrdn’s Devan Kaloo looks at how the US presidential election result might impact emerging market equities.

In abrdn’s latest Investment Outlook we provide our latest house view, our scenarios around the US presidential election and a series of topical perspectives from our asset class experts.

abrdn’s commitment to long-term financial wellbeing, via tools and knowledge for long-term savings and investments to prepare future generations for retirement.

abrdn addresses the gap in active ownership global bond market by aiming to enhance bondholder stewardship practices.

Abby Glennie, Deputy Head of Smaller Companies, provides an update on performance, activity and outlook on the abrdn UK Smaller Companies Fund.

Investors often hold cash for yield and liquidity. Mark Munro and Paul Mehta discuss Global Fixed Income Funds that offer attractive yields and mitigate volatility amidst falling cash yields.

Katie Trowsdale at abrdn Investments explores multi-asset opportunities beyond the Magnificent Seven with MyFolio.

Find out if an allocation to fixed income could help smooth the way with abrdn's Jamie Irvine.

abrdn explains how using multi-asset funds in your CIP can boost business valuation by streamlining operations, reducing costs, and freeing up client time.

abrdn advocates for strategic income investing in diverse assets to enhance financial resilience and maximise returns, offering both stability and growth opportunities for your clients.

Four of abrdn’s senior investors give their top ideas for the rest of 2024 and beyond, based on the company’s latest global outlook.

abrdn explains why the logistics sector currently offers compelling value.

With inflation falling, the ECB is poised to cut rates. Here’s what it could mean for investors.

APAC investors: look west not east for real estate opportunities.

Our summary of developments in emerging market debt in April 2024 and outlook.

Take a look at our upcoming live and on demand webinars to watch at a time that suits you.

Investment Solutions

Our MyFolio fund ranges offer you a cost-effective investment solution, so that you have more time to focus on your clients.

It’s easier than ever to invest in a way that has the potential to make a difference and provide financial returns for your clients.

Our diverse range of equity strategies enables you to match your clients needs for growth, income or both – and always at an appropriate level of risk.

Today’s fixed income markets offers you a wealth of ways to meet your clients needs for income, capital preservation and risk diversification.