Sponsored content

All investment strategies have the potential for profit and loss, capital is at risk. This article was produced in February 2023 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Lucy Haddow, product specialist on the Managed Fund, considers the future of growth companies, reflects on a difficult market and explains why the team remains optimistic.

While 2022 may have been one of the toughest years in its nearly 36-year history, the managers of the Baillie Gifford Managed Fund are feeling notably more confident about the year ahead. Falling valuations have given them a range of new opportunities across both fixed income and equities. Expectations have been reset, and they believe structural growth companies can still thrive in this environment.

The most notable reset has been in fixed income. After an extraordinary period, yields have moved sharply, creating a far broader opportunity set. Lucy Haddow, product specialist on the Fund says: “Yields have been so unattractive, particularly in developed market government bonds. In 2020, there were $18 trillion in government bonds with a negative yield. As of January this year, there aren’t any, even in Japan.”

She says at the end of last year, much of the investment-grade universe was trading on yields not seen since the 2008 financial crisis. Nevertheless, there will be casualties as the economic environment worsens, and investors need to balance the need for near-term resilience with long-term opportunity.

Government bonds can act as a diversifier once again. Haddow says that the Fund’s weighting in developed market government bonds had dropped significantly, reflecting the asymmetry of risk and returns. They provided neither yield nor diversification. Until relatively recently, the fund managers preferred cash. Haddow adds: “We’re holding more in developed market government bonds than before, believing they can fulfil that safe haven, diversification role once again while also adding to returns.”

Fund manager conviction

The £6.3bn fund is, in many ways, the purest expression of Baillie Gifford’s style, drawing on the various regional equity and fixed income teams which contribute their best ideas to it. As such, it will reflect where each team is finding opportunities and where they have the highest conviction.

On the equities portion of the portfolio, the fund managers have added despite a difficult market. This has been painful in the short term, but they believe it will position the Fund well for the long term. Their equity allocation has been driven by the enthusiasm of the underlying Baillie Gifford managers, who say they are finding opportunities after the tough markets of 2022.

Haddow says: “The various fund managers were coming to the investment meetings, particularly towards the end of last year, telling us that they were finding a lot of ideas and that the valuations of existing holdings looked attractive.” There are still plenty of businesses that can grow their revenues and margins. She says that while last year was one of survival for lots of businesses, this year will be one of execution. Companies have reset expectations, and they will be judged on whether they can hit those expectations.

At the moment, 78.5 per cent of the portfolio is invested in equities, high on historic measures although well within guidelines of 75 per cent, plus or minus 10 per cent. The main increases in allocation have been to the UK, emerging markets and developed Asia. UK equity is now around one-fifth of the portfolio and includes companies such as Greggs. While perhaps not an obvious ‘growth’ stock, Haddow says that growth comes in different flavours, and “this is compounding growth rather than transformative growth”. The group has been expanding its out-of-town stores and extending its product range. Its brand recognition and value proposition is also useful in a cost-of-living crisis.

Other new ideas in the portfolio are more obvious growth options such as healthcare businesses Evotec or CRISPR Therapeutics. The managers have not been tempted to add to their holdings in areas such as oil and gas, in spite of its recent strength, believing that the long-term growth prospects are weak. The Fund holds Reliance Industries in India, but less for its oil and gas business and more for its telecoms exposure.

Haddow says: “For Reliance Industries, more than 50 per cent of its revenues come from its refining business, but it has developed one of the cheapest 4G networks globally, and it is currently rolling out 5G. It is also reinvesting its oil and gas profits into affordable green technology. That’s where we have to look at the businesses themselves and not just the sector they’re in.”

Growth companies

The managers are also sticking with many of the growth companies that will be familiar to long-standing investors in the Fund, such as Amazon, Tesla, Shopify and Moderna, despite their recent weakness. It has also stuck with companies with Chinese exposure. It still holds Japanese cosmetics group Shiseido, for example, which has significant exposure to the Chinese tourist market and should be a beneficiary of the country’s reopening.

However, Haddow isn’t counting any chickens: “It’s been a more positive start to the year, but so much is still being driven by inflation expectations and shorter-term factors. We have seen companies reset expectations, and valuations are lower, so there should be a better pathway to growth. Our focus is on balancing near-term resilience with long-term opportunity.”

She sees companies taking the right actions in a very tough environment – cutting costs, focusing on operational efficiency and looking for a path to profitability. Online furniture and home goods company Wayfair, for example, is looking to generate £1.4bn of savings this year. “It will be judged by the market on its ability to cut costs, but it has still got a colossal long-term opportunity ahead of it.”

Is she worried about a tougher market for growth investors? “We are often characterised as investing in growth companies that aren’t yet profitable, but 88 per cent of equities in the Fund are profitable or generating positive free cash flow.” She adds that companies in the portfolio generally have lower debt than the market. As such, they are not as vulnerable to higher borrowing costs.

Overall, Haddow says they are happy with the shape of the Fund today and the prospects for companies within it, although it could be a tough period ahead for even the best businesses in the world. The past 12 months have provided an important reset for financial markets, and investors may benefit in 2023.

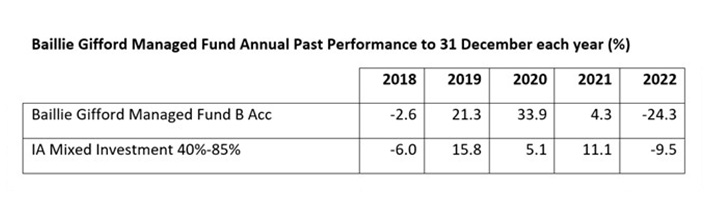

Source: FE, StatPro, net of fees, total return in sterling. Class B Acc Shares. The manager believes an appropriate comparison for this Fund is the Investment Association Mixed Investment 40-85% Shares Sector median given the investment policy of the Fund and the approach taken by the manager when investing.

Past performance is not a guide to future returns

This article does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

The Fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced. Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates.

Bonds issued by companies and governments may be adversely affected by changes in interest rates, expectations of inflation and a decline in the creditworthiness of the bond issuer. The issuers of bonds in which the Fund invests, particularly in emerging markets, may not be able to pay the bond income as promised or could fail to repay the capital amount.

Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority. Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs. All data is sourced from Baillie Gifford & Co unless otherwise stated.

Author bio: Lucy Haddow, Client Service Director

Lucy is a Director in our Clients Department. She is also a Managed Fund Product Specialist. Before joining Baillie Gifford in 2013, Lucy spent four years at Ernst and Young in their Assurance and Transaction Support departments. In 2012 she qualified as a Chartered Accountant. Lucy graduated BA (Hons) in Politics from the University of Durham in 2009.