SPONSORED CONTENT

All investment strategies have the potential for profit and loss, capital is at risk.

Last year was a miserable year for almost all investors, but perhaps particularly so for multi-asset investors. The careful asset allocation and diversification on which they had built their portfolios proved fruitless, with the majority of asset classes sliding lower. Nevertheless, the team on the Baillie Gifford Sustainable Multi Asset Fund is undeterred, saying the potential returns on offer in key asset classes haven’t been higher since the financial crisis of 2007/08.

That enthusiasm is tempered somewhat by their view that the probability of a recession in the US is high – at least within the next 12-18 months. In this environment, bonds in particular appear to hold significant value. Steven Milne, Multi Asset investment specialist at Baillie Gifford, says: “We held few government bonds in the portfolio at the start of 2022, but as rising rates and inflation are increasingly reflected in yields, it is now the largest single asset class across the portfolio.” Among the Fund’s top 10 holdings are the Baillie Gifford Emerging Market Bond and Sustainable Emerging Market Bond Funds, and a basket of emerging market high-yield corporate bonds.

The Sustainable Multi Asset Fund can be fully flexible in where it invests. Milne says: “We don’t have a typical asset allocation, but we have maximum constraints on how much we can hold in any one asset class. As long as we’re invested in a minimum of five asset classes, we’re free to invest wherever we consider to be the best allocation of capital at the time.”

Within fixed income, the fund managers are also bullish on structured finance, predominantly in the collateralised loan obligation (CLO) market. Alongside high starting yields, these assets have floating rates, which can help balance the fixed rates of conventional bonds. The Plutus CLO Fund currently makes up 3 per cent of the Fund and is the sixth largest holding, while the Galene Fund, an actively managed fund focusing on investment-grade structured finance assets, makes up 2.7 per cent and is the ninth largest holding.

Fund aims

The Baillie Gifford Multi Asset range starts from the premise that asset allocation will be the main driver of returns. That marks it out from the rest of the Baillie Gifford funds, where successful stock picking is key. For the Multi Asset Team, asset allocation is driven by macroeconomic analysis, long-term asset class return expectations, and shorter-term scenario analysis. “We’re taking macroeconomic views, combining these with other expert insights and then starting to look at the best way to allocate capital across the funds. We invest across a wide range of asset classes,” says Milne.

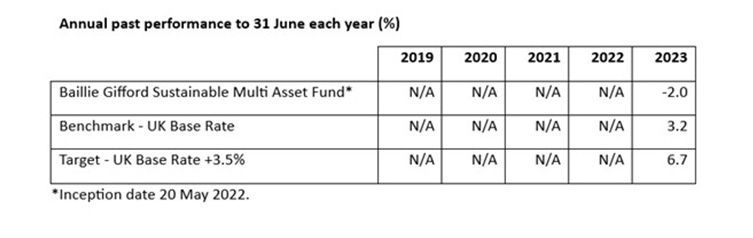

The Sustainable Multi Asset Fund starts with three clear targets: an annualised return over rolling five year periods of the UK base rate, plus 3.5 per cent. Annualised volatility must be below 10 per cent over the same period – roughly half the volatility of equities. The Fund also aims to have a carbon footprint that is lower than that of its stated carbon budget. The carbon budget is set in absolute terms and will decrease at a steady annual rate of 7 per cent per annum.

Asset allocation is based on the team’s work on long-term return expectations, which looks at the likely returns for all the different asset classes over the next decade and beyond. This gives a sense of an asset class’s fair value relative to its peers.

This sits alongside the team’s shorter-term scenario analysis. Milne says: “This is where we’re looking at the drivers for the world economy over 12-18 months. More recently, for example, that has seen us come out of equities and into government bonds. We don’t have to have an allocation to any single asset class. We can invest where we want – and we can take quite diverse positions.”

Implementation

Milne adds: “In terms of how it’s implemented, it’s a mixed bag. It would be remiss of us not to use other Baillie Gifford funds. We tend to find our largest concentration of Baillie Gifford funds is within equities. We’re predominantly a long-only equity house, so we feel we can get value by using them. We also have Baillie Gifford’s Emerging Markets Bond and High Yield Bond Funds in there.”

These sit alongside positions in external funds in areas where Baillie Gifford may have less expertise – such as CLOs, or structured finance. The Fund may also take individual positions in areas such as commodities. At the moment, it holds a direct position in two rare earth miners, plus allocations to copper and silver.

Sustainability overlay?

The team sought to take the multi-asset philosophy of active asset allocation combined with long-term growth across a broad range of asset classes, and apply it to a fund with sustainability credentials. This was very much client-led, says Milne. The sustainability element comes into the process from the beginning, forming a key part of the Fund’s eight-question framework.

He says: “The fifth question is ‘is this investment compatible with a sustainable economy?’. We want to contribute to a sustainable economy that is meeting the needs of the current generation, but also target companies and investments that will meet the needs of the next generation.”

In addition to managing the whole Fund within a carbon budget, the team also applies exclusions based on the United Nations Global Compact and revenue-based screening in areas such as fossil fuels and tobacco. The Fund prospectus provides further information on the screens/exclusions applied.

There are challenges, says Milne, and it can be difficult to define what sustainability means for every asset class. Many of the funds we hold have a sustainable version. The Sustainable Emerging Market Bond Fund, for example, may look at how economies and countries are contributing to sustainable goals, and he admits that can be a tough call.

It can be tricky even in more traditional asset classes, such as infrastructure: “There may be quite high carbon emitters in there, but they’re also contributing to the transition to a greener economy. There have been some instances when our traditional multi-asset funds have been able to hold the asset and the Sustainable Multi Asset Fund can’t. For example, German energy company RWE is important for the transition but its carbon emissions are so high it would limit our ability to allocate parts of the budget elsewhere.”

The team holds the sustainable version of funds, such as the Global Alpha Paris Aligned and Responsible Global Equity Income Funds, while also holding the Positive Change Fund. The commodities allocation will also be focused on those areas contributing to a greener economy – that might be commodities that are important in the production of wind turbines and electric vehicles, for example.

The Fund currently has around £310m in assets, around half of which came from current clients that moved over when it launched in May 2022, with the remainder from new Baillie Gifford clients. The Fund is down 1.3 per cent over one year. However, this performance has come against the significant headwind of a rotation from growth to value, which has dented most of the Baillie Gifford range.

Today, the team recognises that the environment is tough but also that valuations have improved, particularly within fixed income, creating real opportunity. The sustainability overlay should also provide a boost at a time when more capital is going into the green energy transition and other projects. Flexibility will be key in an unpredictable environment.

INVESTOR BIOGRAPHY

Steven Milne

Investment Specialist Manager

Steven Milne is a Multi Asset investment specialist. He joined Baillie Gifford in 2011. Steven graduated with a BA in Business Studies in 2005 from Robert Gordon University in Aberdeen.

Source: FE, Revolution, net of fees, total return in sterling. Class B Acc Shares.

Past performance is not a guide to future returns.

The Fund aims to achieve (after deduction of costs):

- an annualised return over rolling five-year periods that is 3.5% more than UK Base Rate

- a positive return over rolling three-year periods

- annualised volatility of returns over rolling five-year periods that is below 10%.

The Fund also aims to have a weighted average carbon intensity that is lower than its stated carbon budget. The carbon budget is set in absolute terms and will decrease at a steady annual rate of 7% per annum.

The manager believes this is an appropriate target given the investment policy of the Fund and the approach taken by the manager when investing. There is no guarantee that a positive return will be achieved over rolling three-year periods, or any time period.

The Fund does not guarantee positive returns. It aims to limit the extent of loss in any short term period to a lower level than equities.

The Fund invests according to sustainable and responsible investment criteria which includes employing carbon screens. This means it cannot invest in certain sectors and companies. The universe of available investments will be more limited than other funds that do not apply such criteria/ exclusions, therefore the Fund may have different returns than a fund which has no such restrictions.

Risk factors and important information

This article does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

The Fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced. Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates.

Bonds issued by companies and governments may be adversely affected by changes in interest rates, expectations of inflation and a decline in the creditworthiness of the bond issuer. The issuers of bonds in which the Fund invests, particularly in emerging markets, may not be able to pay the bond income as promised or could fail to repay the capital amount.

Baillie Gifford & Co Limited is authorised and regulated by the Financial Conduct Authority. Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs. All data is sourced from Baillie Gifford & Co unless otherwise stated.