Share prices in China generally fell less heavily in March than other major equity markets. While most share indices posted double-digit losses during the month – and since the start of the year – China’s benchmark Shanghai Composite Index fell by a comparatively muted 4.5% during March and by 9.8% during the first quarter.

- China reported dismal economic data for January and February

- Lower demand for commodities is expected to hit Latin American economies

- Brazil’s central bank cut its key Selic rate

To view the series of market updates through March, click here

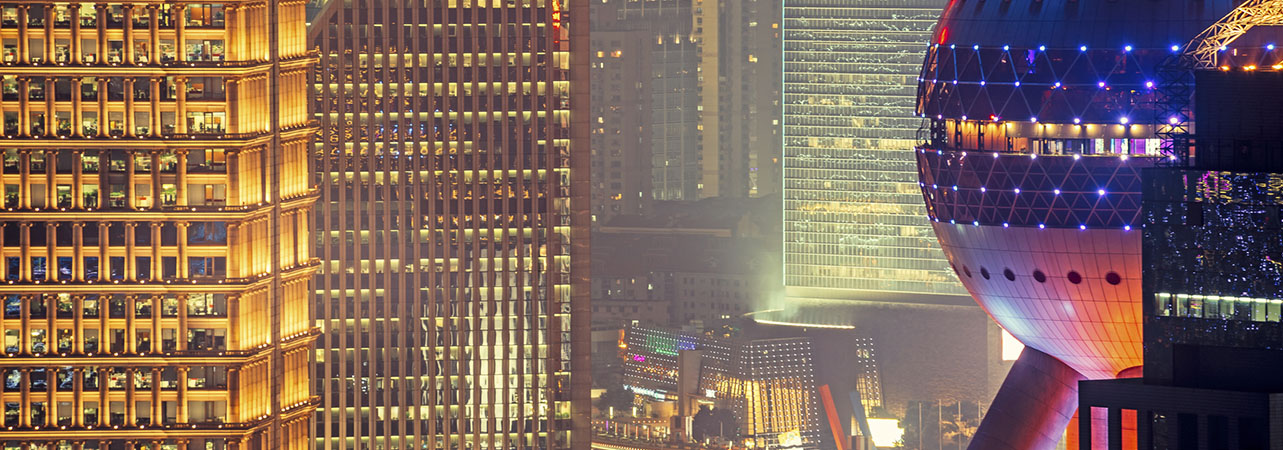

Share prices in China generally fell less heavily in March than other major equity markets. While most share indices posted double-digit losses during the month – and since the start of the year – China’s benchmark Shanghai Composite Index fell by a comparatively muted 4.5% during March and by 9.8% during the first quarter. By the end of March, according to the World Health Organisation (WHO). 82,545 cases of Covid-19 had been diagnosed in China, with 3,314 deaths recorded. China’s central bank moved to support the economy by cutting its reserve requirement ratio from 1.5% to 1% for eligible banks, and injecting 550 billion yuan into the economy.

“Early indicators suggest that China’s economy may have rebounded in March”

Industrial production fell sharply during the first two months of the year, according to the National Bureau of Statistics (NBS), which reported an annualised drop of 13.5% in January and February, compared with growth of 6.9% in December. Meanwhile, industrial profits declined at an annualised rate of 38.3% during the same two-month period and retail sales dropped by 20.5% year on year. Nevertheless, early indicators suggest that China’s economy may have rebounded in March, albeit from a very low base.

Credit ratings agency Fitch warned that the coronavirus-related decline in commodity prices is likely to hit Latin America, with Brazil, Chile and Peru particularly exposed to lower demand from China for raw materials. Brazil’s main economic indicators remain weak, according to Fitch, which reported that many sectors are not yet on track.

Policymakers at Brazil’s central bank expect the coronavirus to impart three shocks to the economy: a supply shock, a production costs shock, and a shock to demand. The Copom cut its key Selic rate from 4.25% to 3.75%, but officials remain reluctant to implement further loosening of monetary policy, describing excessive cutting as “counterproductive”. The Bovespa Index fell steeply, dropping by 29.9% during March and by 36.9% during the first quarter.

The Reserve Bank of India (RBI) cut its key interest rate by 0.75 percentage points to 4.4% in an unscheduled move designed to tackle the economic impact of the coronavirus. The RBI also cut the Cash Reserve Ratio – which dictates the amount that lenders have to hold in reserve – by one percentage point to 3% in order to boost liquidity. The CNX Nifty Index fell by 23.2% during March and by 29.3% during the first three months of the year.

A version of this and other market briefings are available to use in our newsletter builder feature. Click here