While other countries confirmed their slide into recession in July, China’s economy managed to buck the trend, notching up annualised growth of 3.2% in the second quarter after a first-quarter contraction of 6.8%. Over the first half of the year as a whole, the country’s economy shrank by 1.6%.

- China’s services sector grew at its fastest rate in over a decade

- China’s employment backdrop remains weak

- Economic activity rallied in Brazil

To view the series of market updates through July, click here

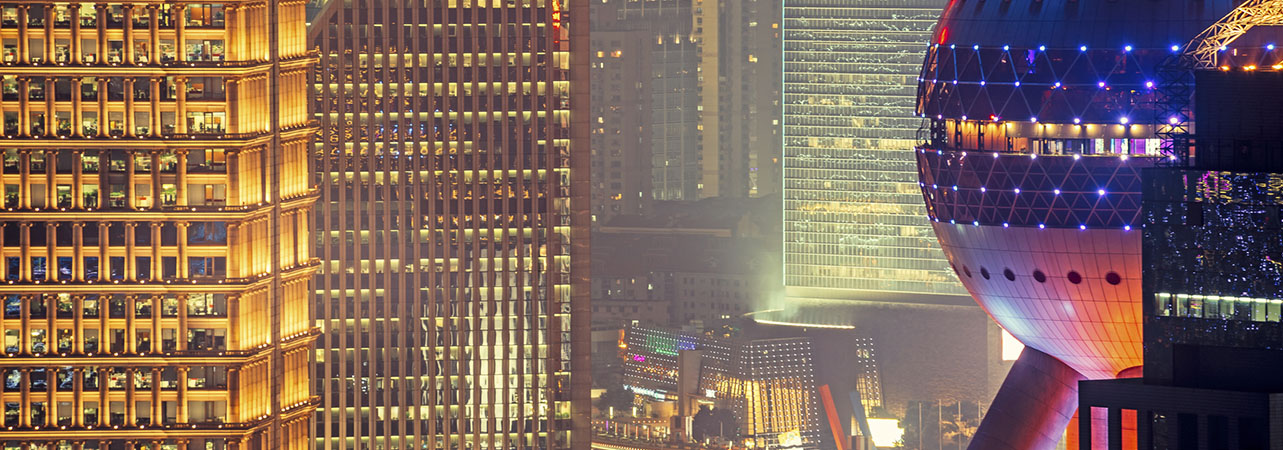

While other countries confirmed their slide into recession in July, China’s economy managed to buck the trend, notching up annualised growth of 3.2% in the second quarter after a first-quarter contraction of 6.8%. Over the first half of the year as a whole, the country’s economy shrank by 1.6%. Investors were heartened by better-than-expected trade data: exports rose at an annualised rate of 0.5% in June and imports climbed by 2.7%. China’s industrial production rose at an annualised rate of 4.8% in June, representing its third straight month of growth. The Shanghai Composite Index increased by 10.9% over July.

“Once in a lifetime events” seem to be more frequent than even “once in a decade” (RBI Governor Das)

China’s services sector grew at its fastest rate in over a decade during June and new orders rose at their most rapid pace since 2010, boosting optimism that the economy will continue to rebound from the coronavirus pandemic. According to the Caixin Services PMI for June, business confidence improved to a three-year high; however, the employment backdrop remains weak, raising questions over the outlook for consumer spending. Having fallen by 2.8% in May, retail sales fell at an annualised rate of 1.8% in June, representing their fifth consecutive month of decline.

Brazil’s economic activity rallied during June after steep declines in April and March. The IBC-Br Index rose by 1.31% in May following a drop of more than 9% in April. On an annualised basis, economic activity fell by 14.24%. Although Brazil continued to grapple with the impact of the coronavirus pandemic – with more than 2.5 million cases diagnosed and over 90,000 deaths – the Bovespa Index rose by 8.3% during July.

Governor of Reserve Bank of India (RBI) Shaktikanta Das warned that the outlook for India’s economy is still uncertain: supply chains are not fully restored and demand conditions have yet to normalise. Meanwhile, the long-term impact of the pandemic on India’s economy remains unclear. Governor Das also observed that the global financial crisis, coupled with the Covid-19, have dispelled any belief that shocks to financial systems are rare. He observed: “Shocks to the financial system dubbed as ‘once in a lifetime events’ seem to be more frequent than even ‘once in a decade’”, and highlighted the necessity for financial institutions to have more substantial financial buffers in order to absorb the impact of economic crises. The CNX Nifty Index rose by 7.5%.

A version of this and other market briefings are available to use in our newsletter builder feature. Click here