Economic data released in September fuelled hopes that China’s post-Covid economic recovery might be gathering pace. Industrial production rose at its fastest rate since December, climbing at an annualised rate of 5.6%, and retail sales posted their first positive growth during 2020.

- China’s exports rose strongly

- Developing Asian economies are set to contract by 0.7% in 2020

- Brazil fell into recession

To view the series of market updates through September, click here

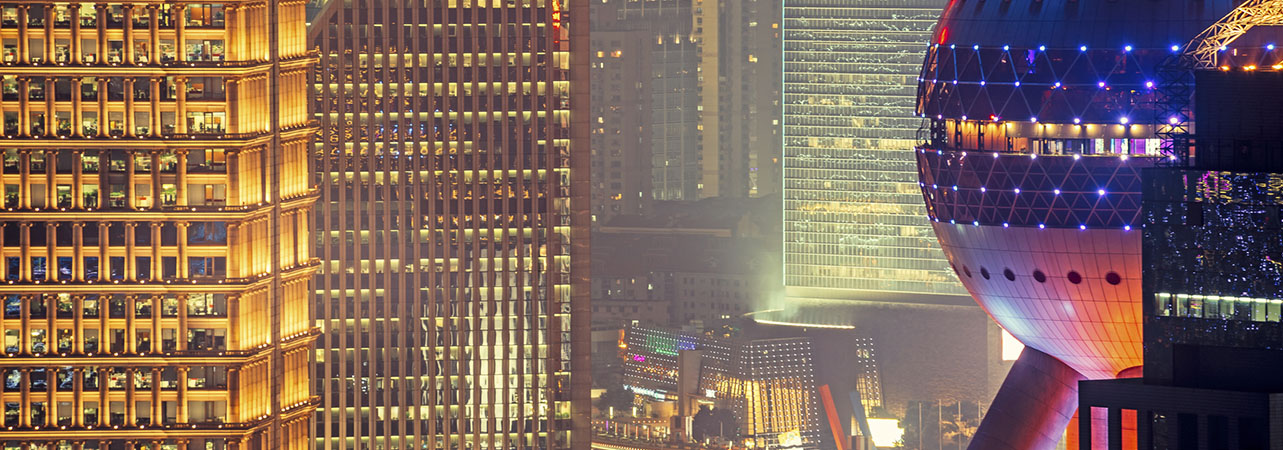

Economic data released in September fuelled hopes that China’s post-Covid economic recovery might be gathering pace. Industrial production rose at its fastest rate since December during August, climbing at an annualised rate of 5.6%, and retail sales posted their first positive growth during 2020 in August, rising at an annualised rate of 0.5%. Sales of communications appliances increased by 25.1% year on year, while car sales rose by 11.8% and commodities by 11.4%.

“Coronavirus has pushed Asia’s developing economies into recession for the first time in almost 60 years”

As overseas economies emerged from lockdown, China’s exports rose at an annualised rate of 9.5% in August, boosted in part by shipments of medical supplies. However, there are fears that overseas demand could peter out if a second wave forces countries back into lockdown. Over September, the Shanghai Composite Index fell by 5.2%.

The Asian Development Bank (ADB) reported that coronavirus has pushed Asia’s developing economies into recession for the first time in almost 60 years. The ADB expects developing Asian economies to contract by 0.7% this year, after which it is forecast to recover to achieve growth of 6.8% in 2021.

Brazil’s economy fell into recession during the second quarter, shrinking by a record 9.7% following a first-quarter drop of 2.5%. The contraction was caused by “historical” declines of 12.3% in industry and of 9.7% in services as a result of coronavirus-related shutdowns and social distancing. Together, industry and services account for 95% of the country’s economy. The Bovespa Index fell by 4.8% during September.

Deficits in Latin American economies are set to narrow in 2021 according to credit ratings agency Fitch, underpinned by a return to economic expansion, higher commodity prices, and the winding-down of fiscal support packages. Nevertheless, recovery is likely to be uneven and may be hampered by a lack of political will for reform. Social and political pressures have hampered moves to contain spending growth in the past and are likely to continue to create headwinds.

Recovery from the pandemic amongst emerging markets is under way, according to S&P Global Ratings, but is happening at different speeds in different countries, and social distancing measures have taken their toll on economic growth. S&P believes that a slower-than-expected recovery could place additional pressure on companies, resulting in a higher rate of bankruptcies amongst medium-sized and smaller companies; in turn, this would push up unemployment and undermine financial institutions’ asset quality.

A version of this and other market briefings are available to use in our newsletter builder feature. Click here