January proved to be a month of two halves for China. Although investor sentiment received a boost from the “Phase One” trade agreement with the US, optimism proved short-lived as concerns grew over the spread of the Coronavirus.

- Business shutdowns in China triggered concerns over the impact on global supply chains

- China’s economy grew by 6.1% during 2019

- The IMF cut its forecast for India’s economic growth

To view the series of market updates through January, click here

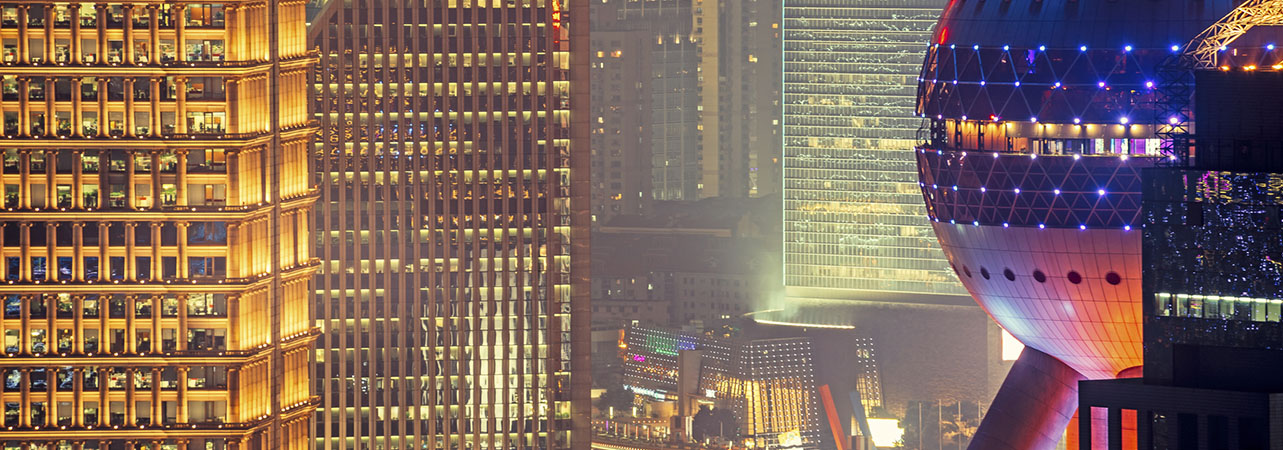

January proved to be a month of two halves for China. Although investor sentiment received a boost from the “Phase One” trade agreement with the US, optimism proved short-lived as concerns grew over the spread of the Coronavirus. The Shanghai Composite Index fell by 2.4% during January, but was in fact shut from 23 January to the end of the month as China’s government extended the Lunar New Year holiday in a bid to curb the spread of infection. As the Coronavirus continued to take hold, transport links were shut down and many companies reduced or suspended their business, triggering worries over the impact on global supply chains.

“China’s government extended the Lunar New Year holiday in a bid to curb the spread of infection”

Elsewhere, China’s industrial production picked up sharply in December from 6.2% to 6.9%, reaching its highest levels since March 2019. However, China’s economy continued its slowdown, posting growth of 6.1% for 2019.

The International Monetary Fund (IMF) sharply downgraded its estimation for India’s economic growth in 2019 from 6% to 4.8% during January. The downgrade also affected the IMF’s global forecast, which was trimmed from 3.4% to 3.3% for this year. The rate of India’s expansion has slowed more sharply than expected, curbed by “stress” in the non-bank financial sector and weak credit growth. Growth is expected to pick up to 5.8% in 2021, lifted by monetary and fiscal stimulus measures and “subdued” oil prices. Over January, the CNX Nifty Index fell by 1.7%.

According to credit ratings agency Fitch, general government debt and deficits in many Latin American economies are actually larger now than they were in 2008, having been driven up by a protracted period of “tepid” growth and sluggish recovery in commodity prices. Latin American economies are vulnerable to a worse-than-expected global slowdown because of their limited fiscal capacity to support growth. Argentina and Ecuador are considered to be particularly exposed; Brazil remains vulnerable because of its high public debt and large deficit, but its future resilience will depend partly on its leaders’ ability to push through reform. During January, President of Brazil’s central bank Roberto Campos Neto warned that Brazil’s economy still requires a cautious approach to monetary policy. The future path of the country’s policy will continue to depend on the economic developments, the balance of risks and the outlook for inflation. The Bovespa Index fell by 1.6% over the month.

A version of this and other market briefings are available to use in our newsletter builder feature. Click here