Global equity markets generally declined during August as existing preoccupations over inflation and monetary policy were exacerbated by intensifying worries over the outlook for China.

- China entered deflationary territory

- Inflation edged higher in the US

- 88% of global companies raised or maintained their dividends in Q2

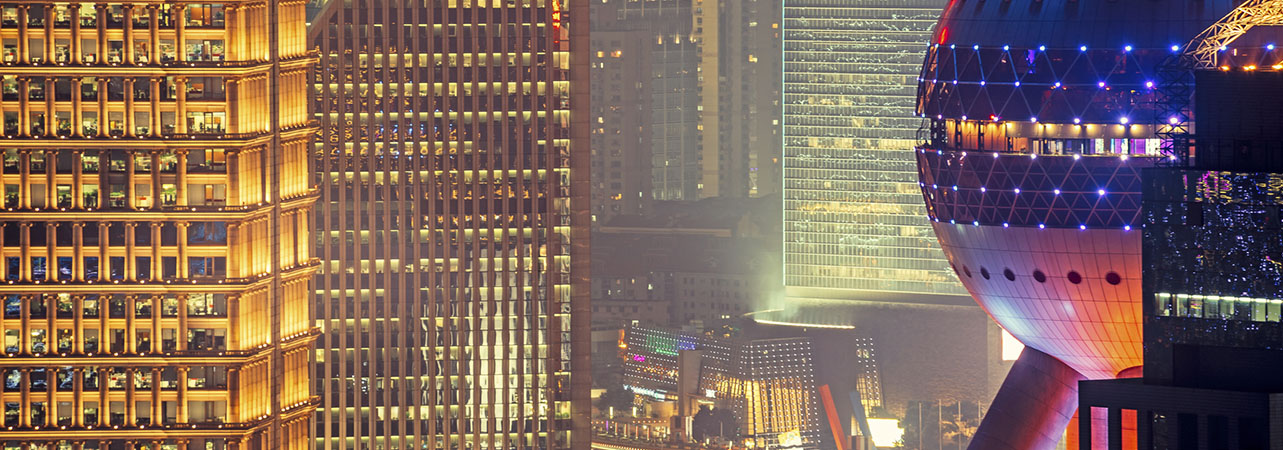

China crisis: global equity markets generally declined during August as existing preoccupations over inflation and monetary policy were exacerbated by intensifying worries over the outlook for China. China tipped into deflationary territory during July as its rate of consumer price inflation fell by 0.3% year on year. Retail sales growth slowed during July, and exports dropped by 14.5% year on year during July, while imports fell by 12.4%. Meanwhile China’s real estate sector came under renewed pressure as property development company Country Garden warned that it could default on its debts. The Shanghai Composite Index dropped by 5.2% over the month.

“Business activity in Germany fell to its lowest level since May 2020”;

Fed continues to focus on inflation: the annualised rate of inflation in the US rose slightly during July from 3% to 3.2%, driven by higher housing, motor insurance and food costs. Minutes from the Federal Open Market Committee’s July meeting showed that policymakers remained vigilant towards inflationary pressures and indicated that further tightening was likely to be necessary unless the backdrop changes. The federal funds rate was raised to a range of 5.25% to 5.5% in July.

“Agile policymaking”: at the annual Jackson Hole economic policy symposium, Fed Chair Jerome Powell warned that rates would be held at “restrictive” levels until officials could be confident that inflation was falling sustainably to 2%, and highlighted the need for “agile policymaking” in an uncertain environment. Over August, the Dow Jones Industrial Average Index fell by 2.4%.

More gloom for Germany: consumer confidence in Germany deteriorated against a backdrop of higher costs for energy and food, according to GfK, fuelling concerns about the outlook for Europe’s largest economy . Meanwhile, the S&P/HCOB Purchasing Managers’ Index found that business activity in Germany fell to its lowest level since May 2020 during August. Manufacturing activity posted its fourth straight monthly decline, while services dropped to a nine-month low. Elsewhere, the country’s economy was confirmed to have stagnated during the second quarter, and to have shrunk by 0.6% year on year. The Dax Index fell by 3% in August.

Banks drive global dividend growth: global dividends rose at a headline rate of 4.9% during the second quarter of 2023, reaching a record US$568.1 billion with banks accounting for half of all global dividend growth during the period. According to Janus Henderson’s Global Dividend Index , 88% of companies either raised or maintained their payouts.

To view the series of market updates through August, click here