The deterioration of factor return premiums is a major worry for smart beta investors. It raises the concern that the back-tested returns of the past will fail to materialise during the life of their investment. This month, we take a look at the persistence of factor premiums over time. In particular, we look at how returns have fared in the last 13 years. In addition, we consider how factor premiums may have faded in some regions more than others. We find that factor premiums have indeed faded and that this seems especially so in the North American region. Other regions, however, still offer positive if more modest factor return premiums.

Key issues this month:

- Factor premiums in the 1990-2004 period were high and of a similar size across the Global and North American markets.

- There has been a fall in factor premiums in the 2005-2017 period, especially for the North American market.

- The erosion in factor premiums suggests investors may wish to avoid the North American markets when implementing a factor portfolio.

“Falling factor returns are a warning sign to investors that the smart beta products of today may not offer returns in the future that can match those of the past.”

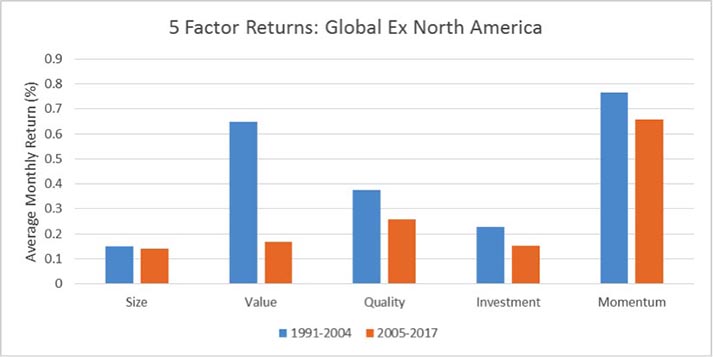

Global Ex North American Factor Returns

We begin by looking at Global factor returns, excluding the United States and Canada, which make up the North American market. Global returns are comprised of 22 major global stock markets including the UK.

The following 5 factors are included in the analysis:

Size: The return of the smallest third of stocks ranked by market capitalisation, minus the return of the third largest stocks.

Value: The return of the cheapest third of stocks with the highest book-to-market ratio, minus the return of the third most expensive stocks.

Quality: The return of the top third of stocks sorted by operating profitability, minus the return of the lowest quality third of stocks.

Investment: The return of the top third of stocks with the lowest change in total assets over the fiscal year, minus the return of the highest investment stocks.

Momentum: The return of the top third of stocks with the highest momentum measured as the percentage increase in share price over the last year (excluding the latest month), minus the return of the bottom third of stocks with the lowest momentum over the last year.

As we are interested in the possible erosion of factor premiums over time, we split a 26 year sample period into 2 sub-samples of 13 years each. The blue bars show the factor premiums over the earlier 1990-2004 period and the orange bars reflect the later 2005-2017 period.

Figure 1: Data taken from Ken R French Data Library

If we begin with the 1991-2004 period, the factor premiums were sizeable, especially in the traditional factors of value and momentum. The other factors also offered positive, although more modest premiums. Moving to the later 2005-2017 period, it is noticeable that factor premiums are lower across all 5 factors. There is quite a sizeable reduction in the case of the value premium but only a fairly modest reduction in the case of the size or the momentum premiums. In summary, there were some reductions in factor premiums in the later period but they still remained positive and sizeable.

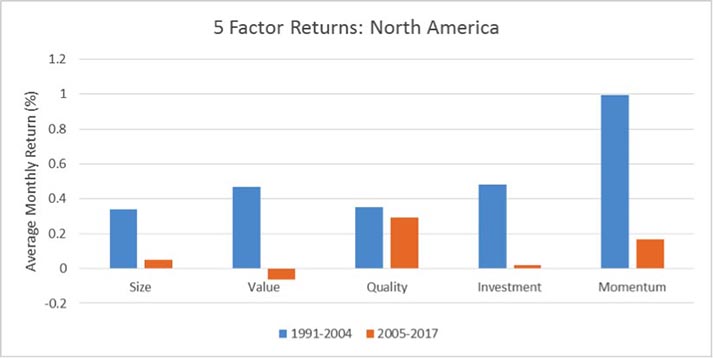

North American Factor Returns

The chart below shows the same data, across the same time periods but for the North-American market consisting of the United States and Canada. Some investors consider these markets the most sophisticated and so it is plausible to think that the erosion in factor premium might be higher in these markets.

Figure 2: Data taken from Ken R French Data Library

Looking at the earlier 1991-2004 period, the factor premiums look similar in magnitude to the global market with momentum again the strongest factor. The value factor premium was somewhat smaller over this time period and investment factor premium a bit larger than the global market. Moving to the later 2005-2017 period, it is noticeable that the size, value and investment factor premiums are virtually indistinguishable from zero, while the momentum premium has been cut dramatically. Only the quality factor premium retained its value, which may be because quality stocks have been in favour since the crash of 2008. In summary, there appears to have been a sizeable fall in factor premiums in the North American market over the last 13 years with only the quality factor maintaining its factor premium.

Conclusion

Falling factor returns are a warning sign to investors that the smart beta products of today may not offer returns in the future that can match those of the past. Having examined the data, it appears that these concerns are justified within the North American markets where smart beta products began and remain popular. If investors choose to invest in smart beta factors, the evidence suggests they would do well to target geographic markets where smart beta is less popular. They may also wish to consider more esoteric factors, which have less chance of being arbitraged away in the future.

Chris Riley, RSMR, May 2018