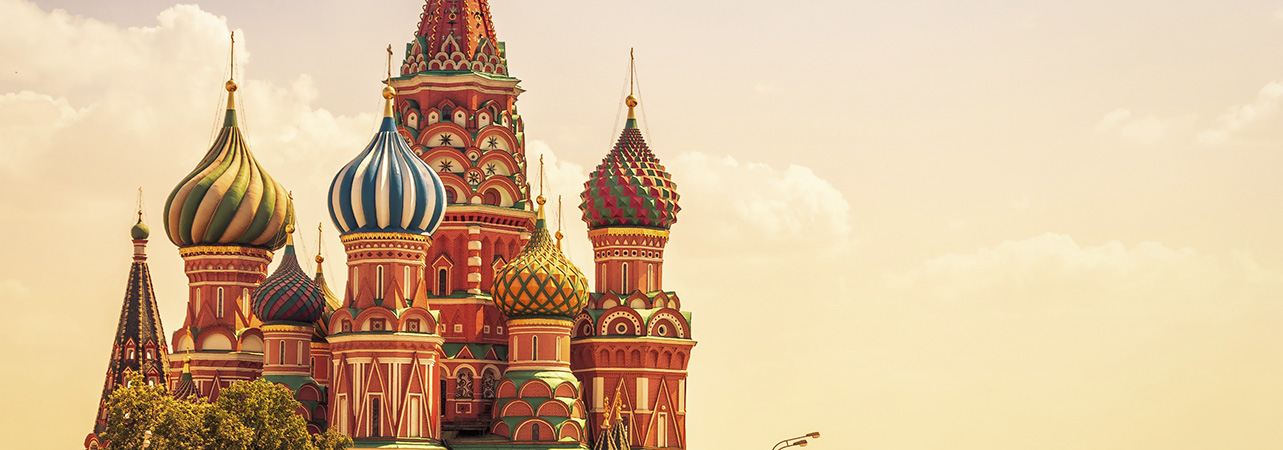

As the crisis escalates, what is the fallout for financial markets from tension on the Ukrainian border?

- Russia continues to build up troops on the Ukrainian border, hoping to secure concessions from NATO allies

- The most significant risk is around energy prices and whether they start to weigh on economic growth

- Markets are likely to be volatile if tensions escalate, but weakness should be short-lived

This week, six Russian landing ships assembled in the Black Sea as part of the country’s ongoing build-up of troops on the Ukrainian borders. It is the latest salvo in an escalating conflict. Aside from the very real prospect of a military clash, what is the potential impact on economies and markets?

There are multiple possible scenarios and predicting the next action from the enigmatic Putin is tough. It may be that his only goal is to bring Western powers to the table and he will be satisfied with a range of concessions. This seems unlikely, but a full-scale military intervention wouldn’t be in Putin’s interest either. The most likely scenario is that tensions in eastern Ukraine remain elevated and Russia will keep its troops on the border as a bargaining tool.

The West is likely to respond with sanctions of some kind, potentially cutting off Russia’s access to the world’s financial markets, or making it difficult to buy Russian sovereign debt. Taking aim at Russia’s oil and gas supplies into Europe would be a tougher call, with serious repercussions for both sides.

In most scenarios, oil and gas prices rise. The oil price is already up 50% on its level last May and Russia is already thought to be holding some gas supplies from the market. Higher energy prices are economically destructive. Companies and individuals pay more for energy and petrol, leaving them with less disposable income. Even though the world economy is not as sensitive to oil prices as it once was, if energy prices remain elevated, economic growth would still take a hit and stock markets would almost certainly slide.

The most vulnerable areas are those with the greatest dependency on fossil fuels from Russia. Germany, for example, would be hard-hit, along with other parts of Europe, such as Italy and some of the Eastern European countries. If economic growth started to slow, investors may reverse their recent preference for more cyclical parts of the market.

In practice, stock market weakness arising from geopolitical events of this type has tended to be short-lived. Nevertheless, it comes when they are battered by a range of other pressures, including rising inflation and interest rates. It could prove the final straw. Investors need to be vigilant, even if the risks seem remote.