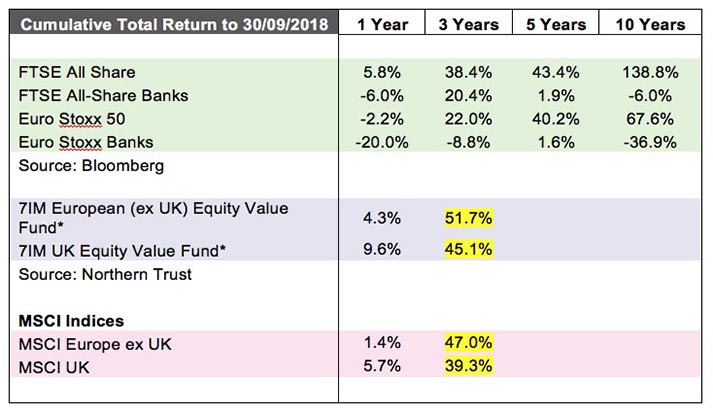

- On a total return basis, the FTSE All Share is up 139% over the last decade to end September. In contrast, the FTSE All Share Banks Index is down -6%

- Banks account for 11.9% of the FTSE 100, 12.2% of the MSCI UK Index and 11.3% of the Euro Stoxx 50 alone

- While there is some signs of a change in sentiment, the remain vulnerable

It is almost exactly a decade since the British government decided to rescue the banks, with a £500 billion package of loans and guarantees. For some years afterwards, banks were a pariah, with fund managers keen to emphasise that they weren’t investing in them, they were too opaque, too risky and full of potentially explosive assets.

Perhaps unsurprisingly, according to research from 7IM, they have underperformed, in spite of the strong rebound in stock markets since the crisis. The group suggested they were ‘still on probation as far as investors are concerned’.

The underperformance has been marked: On a total return basis, the FTSE All Share is up 139% over the last decade to end September. In contrast, the FTSE All Share Banks Index is down -6% over the decade. European banks have fared even worse, with the Euro Stoxx Banks price index down -37% over the decade, whilst the Euro Stoxx 50 price index is up 68%.

They have provided a salutary lesson in why value investing is such a difficult game. There have been lots of times during the past decade when bank valuations have made them look like a cheap option, but they have continued to get cheaper still.

Nevertheless, investors can’t ignore them. Banks account for 11.9% of the FTSE 100, 12.2% of the MSCI UK Index and 11.3% of the Euro Stoxx 50 alone.

Some value managers have started to move back in in recent years. The Schroders Income fund holds over 5% in HSBC and around 3.5% in the Royal Bank of Scotland. Lloyds has also been a popular choice as it has been re-engineered and returned to dividend payments. After a rout in European banking stocks last week, there is anecdotal evidence that a number of active managers are re-examining the sector.

The problem is that there are still wild cards. The Italian political situation is fluid and European banks in particular are vulnerable to problems in Turkey. They are still difficult to analyse and investment managers may feel their time is better spent elsewhere. Nevertheless, rising rates may provide a tailwind for the sector for those willing to take a chance on a volatile and capricious sector.

Source: MSCI