The following article on investing in the UK is an edited version of one of J.P. Morgan Asset Management’s Portfolio Discussions and Quarterly Perspectives, which are designed for advisers to use with their clients in conjunction with slides from the firm’s quarterly ‘Guide to the Markets’

The UK has been among the fastest-growing developed economies over the past few years. Despite government plans for further fiscal entrenchment and the resulting drag on growth, the economy should continue on its positive path as the rest of the developed world advances and domestic wage growth picks up.

- The pace of economic growth in the UK is faster than some of the world’s largest economies

- Medium-sized and smaller companies have particularly high exposure to the improving UK economy

- Many of the world’s developed markets are growing relatively strongly. A robust global economy means more demand for UK goods

The pace of economic recovery has come as a surprise to markets and policymakers alike. At J.P. Morgan Asset Management, we believe stronger economic growth should continue, driven by a stronger consumer and improving trade as the developed world recovery and, more importantly, the European economy gather steam.

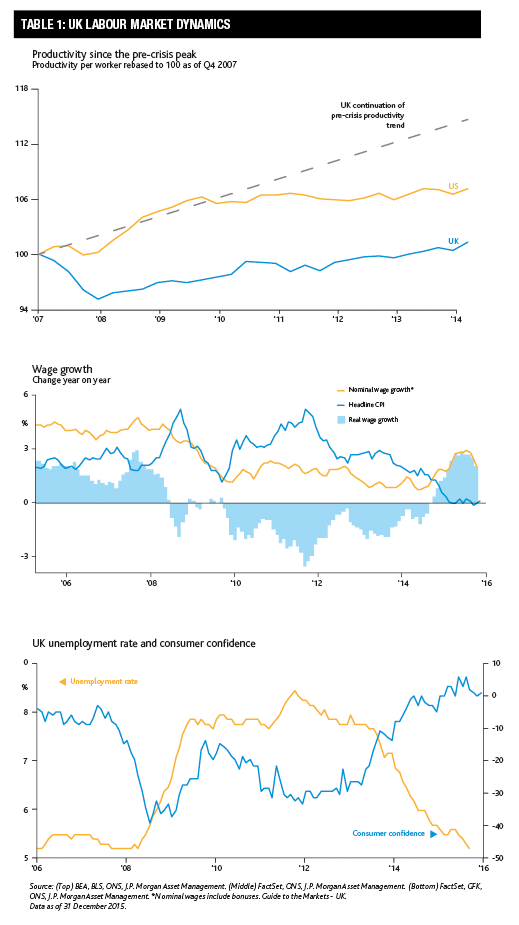

The falling unemployment rate, which can be seen in the bottom chart in Table 1 below, highlights the improving economic situation. Wages are finally increasing faster than inflation but limited inflationary pressure means monetary policy will remain accommodative for a while longer – although we do expect a gradual increase in interest rates in 2016. We also expect consumer demand, driven by higher wage growth and greater employment, to be the main driver of the UK economy.

The pace of economic growth in the UK is faster than some of the world’s largest economies but, crucially, many of the world’s developed markets are also growing at a reasonable pace. Forward-looking economic indicators, such as the purchasing managers’ index for manufacturing, signal that developed economies should continue to grow.

A stronger global economy means more demand for UK goods. The US and eurozone countries are the main buyers of UK products, so stronger US and European economies should help to boost UK exports. When looking at which sectors to focus on, however, the current weakness in emerging market economies should also be taken into consideration.

As the charts in Table 2 help illustrate, UK valuations are relatively attractive. Even though the forward price-to-earnings ratio on the FTSE All-Share index has risen since the depths of the recession, UK equities are not yet very expensive in historical terms. The earnings yield on offer is also very attractive relative to the yield available from government bonds. On a cyclically-adjusted basis, UK equities do look cheap.

At J.P. Morgan Asset Management, we believe investors should take a selective approach to UK equities rather than limiting themselves to the blue-chip stocks of the large-cap UK equity index. The FTSE 100, which is comprised of the very largest stocks listed in the UK, is dominated by the banking and commodity sectors.

It is worth investors and their advisers considering where the UK is in the economic cycle and which sectors of the economy and which size companies will perform the best at each point in the cycle. Small and mid-sized companies have more exposure to the improving UK economy.

‘Investing in the UK’ is one of a number of Portfolio Discussions published by J.P. Morgan Asset Management that also includes ‘Global macro investing’ and ‘Investing for income’. The full range may be found here. All are designed for advisers to use with their clients in combination with slides from the firm’s quarterly ‘Guide to the markets’, which may be downloaded here