The pace of economic growth in China continued to slow during the third quarter, dampened by the ongoing trade conflict with the US. On an annualised basis, China’s economy expanded by 6% over the three months to the end of September, compared with growth of 6.2% in the second quarter and 6.4% in the first.

- India’s economy slowed for a fifth consecutive quarter

- Brazil cut its key interest rate to 5%

- S&P affirmed China’s “A+” credit rating

To view the series of market updates through October, click here

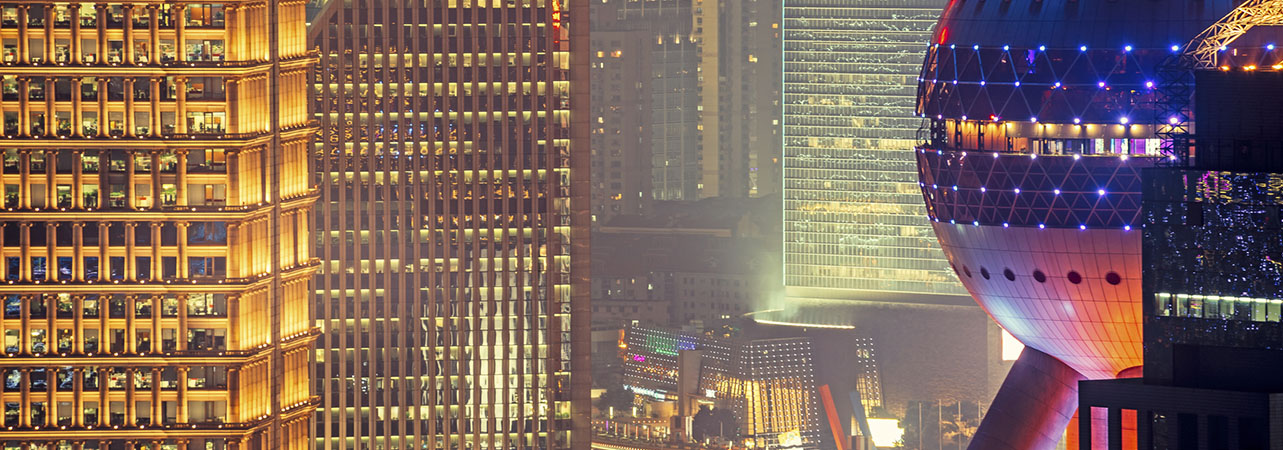

The pace of economic growth in China continued to slow during the third quarter, dampened by the ongoing trade conflict with the US. On an annualised basis, China’s economy expanded by 6% over the three months to the end of September, compared with growth of 6.2% in the second quarter and 6.4% in the first. News of a tentative trade agreement between China and the US was generally welcomed by investors, but the International Monetary Fund (IMF) urged both countries to make further progress in de-escalating trade tensions and to move from a “trade truce to a trade peace”. The Shanghai Composite Index rose by 0.8% over October.

“News of a tentative trade agreement between China and the US was generally welcomed”

Credit ratings agency Standard & Poor’s (S&P) affirmed its “A+” long-term rating and “stable” outlook for China during October. S&P highlighted China’s prospects for above-average headline GDP growth and improved fiscal performance over the next three to four years. Although risks remain to China’s economic and financial stability – notably trade tensions with the US and a slowdown in the country’s rate of economic growth – S&P believes that policy changes have helped to curb credit growth and diluted the economy’s reliance on public investment.

The IMF cut its economic growth forecast for India from 7% to 6.1% in 2019 and from 7.2% to 7% in 2020, citing a weaker-than-expected outlook for domestic demand. India’s economic growth is being held back by a squeeze in credit availability, according to ratings agency Fitch, which found that total new lending in the current fiscal year will drop to 6.6% of GDP, compared with 9.5% last year. India’s economy slowed for a fifth consecutive quarter during the second quarter, posting annualised growth of 5% compared with 8% in the same period a year earlier. Retail price inflation rose from 3.21% in August to 3.99% in September, moving closer to the Reserve Bank of India’s 4% target. In particular, food price inflation surged from 2.99% to 5.11%. During October, the CNX Nifty Index rose by 3.5%.

In response to signs of a slowdown in the global economy, Brazil’s central bank cut its key Selic rate by one-half of a percentage point to 5% and signalled the possibility that another cut might be in the pipeline. The move followed Congress’s approval of pension reforms. The Bovespa Index rose by 2.4% over October.

A version of this and other market briefings are available to use in our newsletter builder feature. Click here