Four members of Invesco Perpetual’s Henley-based Fixed Interest team review how bond markets fared through 2015 and assess the asset class’s prospects for 2016 and beyond

We are moving from a market dominated by the echoes of the global financial crisis to one that is approaching normality. As the market normalises we expect to see an increasing focus on the macroeconomic cycle and the opportunities this presents.

- The credit market is generally less expensive, but bond yields remain very low

- Investment grade corporate bond markets are still challenging but can deliver much-needed income

- The high yield market has improved, but investors should still manage expectations about the capital upside

What can we expect from fixed interest markets in 2016?

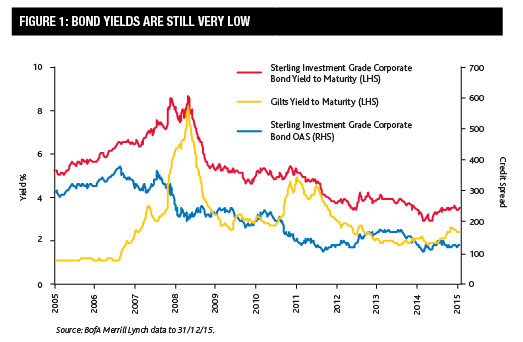

Paul Read, co-head of fixed interest: My expectations for bond market returns through 2016 continue to be modest and investors need to manage their expectations. In 2015, we saw some volatility – particularly within credit markets – and yields and spreads are both higher than at the start of 2015. One needs to be careful though – while the credit market as a whole is less expensive, bond yields are still very low [see Figure 1 to the right] and in many cases the yield increase of bonds we would want to buy has been modest. So while, arguably, we are beginning 2016 in a slightly stronger position than 2015, we remain cautious.

What’s your view on the current macroeconomic environment?

Stuart Edwards, fixed interest fund manager: I think we are at an inflection point where we are moving from a market dominated by the echoes of the global financial crisis in 2008 to one that is approaching normality. Since 2008 the focus has been on capturing distressed opportunities within bonds that trade with a yield spread over core government bonds – in other words credit risk or the risk of default.

“It is important we do not stretch for yield because the market is simply not compensating us for doing so.”

As the market has ebbed and flowed between periods of ‘risk on’ and ‘risk off’ the best opportunities to exploit credit risk have been within financial credit and peripheral European sovereign bonds and this is where we have held some of our larger positions. As the market normalises we would expect to see an increasing focus on the macroeconomic cycle and the opportunities this presents. This should bring to the fore opportunities for duration positioning - yield curve trades, relative value trades and foreign exchange opportunities.

What do you think will be the impact of higher US interest rates on bond markets?

PR: That is an interesting question that has no simple answer. On the one hand, the fact the US Federal Reserve feels confident enough in the US economy finally to begin hiking interest rates is a good thing. It is a sign the US economy and the monetary policy cycle are both returning to normal and, all else being equal, that should in my view be good for both credit and equity markets.

What is more challenging is this is the start of the first hiking cycle for US interest rates for nine years. That is a very long time. A lot of people in the market now have never had the experience of trading through a rate-tightening cycle. This means there is a real risk that, now the tightening cycle has begun, the market could start to price in more hikes. This could in turn lead to greater volatility, particularly within the government bond market. Indeed, if economic data or inflation is stronger than expected, it could become quite challenging for some parts of the bond market.

What about the US dollar?

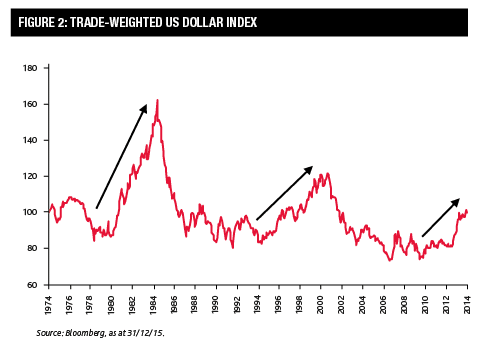

SE: From a multi-year viewpoint I think the strength of the US economy and the Fed’s tightening of monetary policy should be supportive of the US dollar but, in the short term, there will continue to be opportunities to oppose this view. An obvious example is the level of the dollar versus the euro. Ultimately there is no reason why one euro should not be worth one dollar – or indeed why it should not be worth less – but we are likely to see further technical resistance as these levels are tested before the dollar can strengthen further. This could present tactical opportunities.

Is the pick-up in high-yield yields and spreads a cause for concern or has it created opportunities?

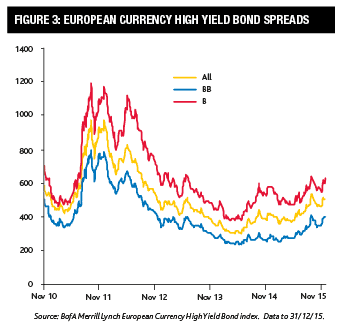

PR: A bit of both. You need to be very careful about looking at generic spread-widening and deciding that a market is cheap, because there is a lot of sector and stock-specific influence over where the index is. And actually, as an investor, when you look at what you want to buy, often it is not that cheap. Having said that, what happened in 2015 has led to a slightly more rational high-yield market. Primary-market pricing is improving, and I do think there are some secondary-market and stockpicking opportunities in fixed income. So, overall, I think the high yield market has improved through 2015 but investors should still manage expectations about the capital upside and think of this as an asset class that has the potential to provide reasonable levels of income.

What is your view on investment grade corporate bond markets?

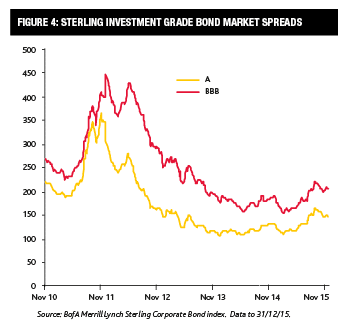

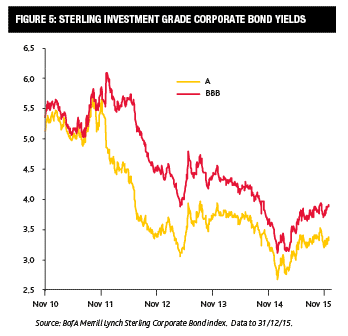

Mike Matthews, fixed interest fund manager: Investment grade corporate bond markets are still challenging. Credit spreads have widened and yields are off their lowest levels. In most cases, however, yields are still low and leave only limited potential for further capital appreciation. As we begin 2016, the market could face headwinds from higher government bond yields, rising default rates in the US and potentially issues surrounding liquidity. This means it is still prudent to remain relatively defensively positioned and hold relatively high levels of liquidity.

In terms of opportunities, the one sector we are still focused on is financials, given they continue to improve their balance sheets and are still under the regulatory spotlight. I think it is increasingly important to focus on individual bonds rather sector selection because spread widening can be significant for issuers that have problems or are involved in mergers and acquisitions. Overall, while we are still able to find opportunities, they are reasonably limited. That said, investment grade corporate bond markets can deliver much needed income and, generally, I prefer them over the alternatives of cash, government bonds or high yield.

Liquidity continues to dominate headlines - what’s your view?

MM: Investors need to be aware of the issues and, as always, make sure they are being paid for the risks. I believe there is a high probability that liquidity never becomes a significant issue given it is so well-known and investors are managing their own liquidity more. However, personally, I expect illiquid markets will create some opportunities and I think it is something we have to consider when managing our portfolios. What I mean by that is investors with cash at a time when others are being forced to sell bonds may be able to drive attractive bargains. This is why across our funds we have for quite some time maintained high levels of liquidity by holding increased levels of cash, government bonds and bonds close to maturity.

Financials remain a big focus for the team – is there still value there?

Julien Eberhardt, deputy fund manager and senior credit analyst: Financials are still relatively attractive in the team’s view, offering a reasonable balance of risk and reward. The strengthening of banks’ balance sheets and a reduction in the amount of risk-weighted assets held has improved creditworthiness. On the other hand, we have seen bank revenues coming under pressure and company-specific issues have been a feature of 2015.

Overall though, subordinated debt performed well through 2015 and I remain positive on the sector. Looking ahead, I think it will remain important to be selective, with in-depth credit analysis crucial. In addition to being cognisant of company-specific risks, I am focusing on three other factors I believe could impact the sector – the tightening of US monetary policy; the increase of political risk as a result of the rise of anti-austerity political parties; and, finally, geopolitical concerns.

What does this all mean for positioning in the funds the team manages?

PR: For our mixed-asset funds, we currently like equity as a source of income – the very low level of bond yields presents a very low hurdle rate for equities to outperform and, over the medium term, we believe there are all sorts of tailwinds supportive of the asset class. Given the potential headwinds facing bond markets and with government bond yields low and credit spreads less than compelling, we are defensive across all the funds. We are maintaining a low duration position, preferring to take credit rather than interest rate risk.

That said, it is also important we do not stretch for yield because the market is simply not compensating us for doing so. In terms of positioning, this means we are focused on the better-quality end of the high yield bond market, some investment grade corporate bonds and the financial sector. Against this, we have a lot of liquidity across the board. This gives us a lot of flexibility so, if volatility picks up, we are well positioned to take advantage of it.