Last month we looked at two factors that are predictive of a future recession: the rate of inflation and the level of unemployment, and found that the signs of a new recession were not quite in play yet. This month, we explore the related issue of future equity returns. Two of the strongest predictors of future returns are money supply growth and the rate of unemployment. We find that high money supply growth and low rates of unemployment have been associated with future market corrections.

Applying this insight to current market conditions, although the low rate of unemployment does suggest that we have reached a market top, the rate of monetary growth is not yet high enough to suggest a large correction is imminent. Thus, the data presents a mixed picture for the future prospects of the equity market.

Key issues this month:

- The current rate of money supply growth under 5% does not suggest that a downturn in equity markets is likely.

- The current rate of unemployment of 4.5% is in line with 2008 and suggests that a market correction is likely.

- The overall picture suggests that monetary conditions are not in line with a market top, even though the underlying economy, reflected in low unemployment, is strong.

Money Supply and Future Returns

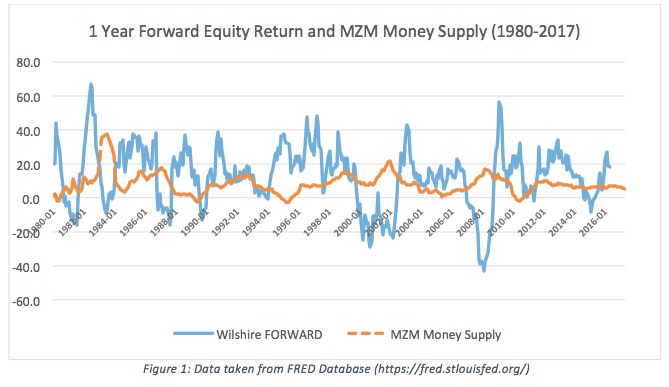

The money supply has become a key variable monitored by central banks since the early 1980’s. The chart below shows 1 year forward equity returns, using the Wilshire 5000 total market index, against the annual growth rate in the MZM Money supply. The stock market data ends a year before the money supply data, as we are using the 1-year forward information so that the relationship is predictive.

All of the periods of negative returns have been associated with high rates of monetary growth, excluding the market fall in 1982. The market falls in 1987, 2000 and 2008 were associated with tops in money supply growth of around 20% per annum. High money supply growth signals that the market is overheating, which may lead to the associated falls in the share market. The current rate of monetary growth of 4.5% does not appear to be at danger levels based on previous falls in the market.

Unemployment and Future Returns

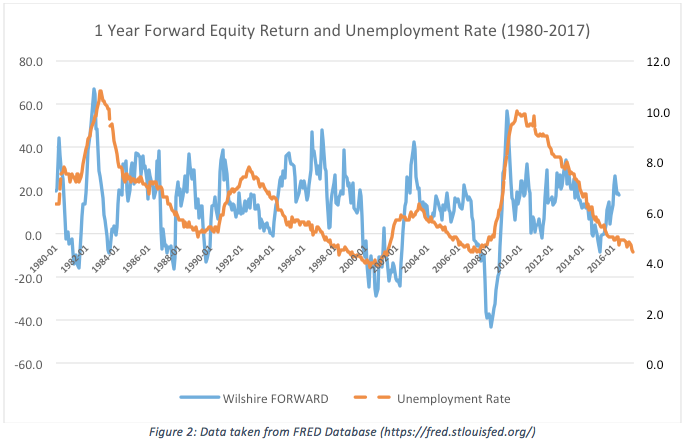

We found last month that low rates of unemployment are a key predictor of future recessions, as central banks are keen to raise rates at these times. The chart below shows the relationship between unemployment and 1-year forward equity returns.

Just as we found a strong relationship between unemployment and recessions, there is also a strong relationship between future equity returns and unemployment. Low rates of unemployment signal strong economic performance and a top in the equity market. The unemployment rate has a particularly strong relationship with future returns in the last 3 market collapses of 2008, 2000-2002, and 1990. The downturn in 1987 is an unusual case in that the market decline was not driven by a recession in the underlying economy and hence the link with unemployment is not present. In summary, low rates of unemployment are associated with low annual returns in the equity market and the current rate of unemployment suggests we are at danger levels.

Conclusion

While the drivers of future stock market returns are similar to the drivers of future recessions, the CPI rate appears to play a smaller role as a driver of returns than money supply growth. The rate of unemployment however, appears to be a key driver for both recessions and stock market moves.

The data suggests a mixed picture for future equity returns, as it did last month, for the chance of a recession. The low rate of unemployment is a negative influence signalling a top in the market, but the subdued rate of monetary growth suggests there is room for further growth in share prices.

Chris Riley

RSMR

September 2017