Smart beta ETFs have grown in popularity, in combination with the rise of passive investing. This month we examine whether the best days of smart beta are in the past, and whether the inflows into these products have reduced the alpha that is available to investors? We find some evidence that returns have declined, especially for traditional factors such as value and momentum, and that this decline appears to be most pronounced in the US market and is less marked in Europe.

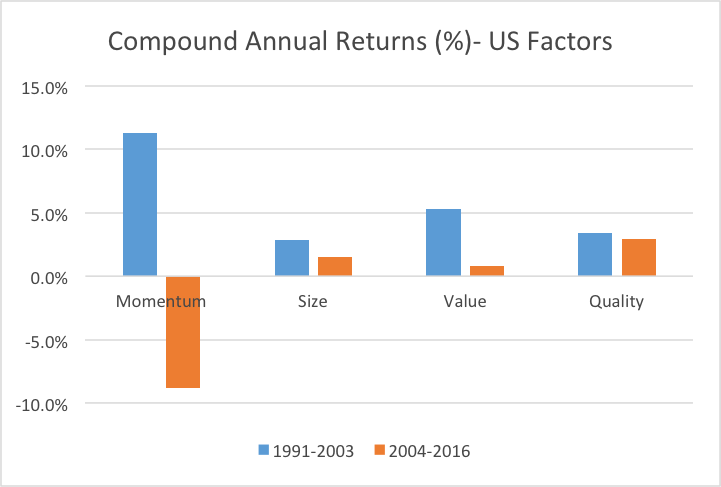

- All four factors have declined in the US market in the post-2003 period

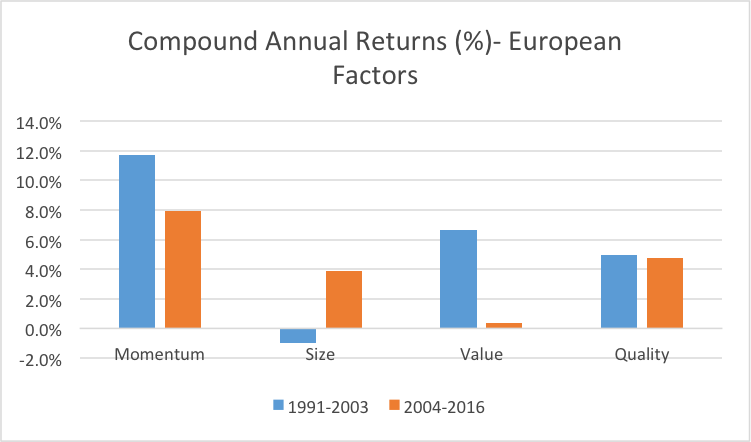

- Momentum and value have declined in the European market in recent times.

- The data suggests investors would be best placed to target more esoteric factors in regions outside the US market

A recently published academic paper suggests that factor returns have declined markedly in the post-2003 period, as these strategies gained attention from investors. We will examine how factors have performed in the pre and post-2003 periods using both US and European data.

The Evidence: US Factors

The graph below shows four traditional factor portfolios: Momentum, Size, Value and Quality. The factors are constructed as long-short portfolios, by subtracting the top third of stocks from the bottom third of stocks, sorted by the relevant factor. The blue bar shows factor returns in the 14 years up to 2003 and the orange bar shows factor returns in the 14 year period post-2003.

Figure 1: Data taken from KEN R French Data Library

It is apparent that all four factors have lower returns in the post-2003 period than in the pre-2003 period. This is clearest in the traditional factors: momentum and value, which may be because they are the most well-known and hence more money has gone into these factors. In the case of size and quality, post-2003 factor returns are also slightly lower than pre-2003, but the difference is not particularly large. "The most common factors, in the most common markets, are in the greatest danger of becoming unprofitable due to the amount of money flowing into factor strategies." The Evidence: European Factors The chart below shows the identical factors and factor construction process, but using European data rather than the US. The European data includes the UK.

Figure 2: Data Taken from Ken R French Data Library

The evidence for factor erosion is not as clear for European data, as for the US. Although the traditional factors: momentum and value, are down for the post-2003 period relative to pre-2003, the size factor has actually performed better post-2003. The quality factor has performed fairly well in both periods, which mirrors the pattern of performance in the US and may reflect the fact that it is a newer factor and so has retained more profitability.

Conclusion

We have looked for evidence of factor erosion, using some of the more common factors, across both US and European markets. There is some evidence that factor returns have eroded post-2003 and even become negative in the case of momentum in the US. The lesson for investors is that the most common factors, in the most common markets, are in the greatest danger of becoming unprofitable due to the amount of money flowing into factor strategies. In this case, we see that the traditional value and momentum factors have performed poorly in the US markets post-2003. More exotic factors are less likely to be arbitraged away by other investors, although they may also have less statistic evidence behind them than the traditional factors.

-

Chris Riley

RSMR

July 2017