Between the Covid-19 outbreak and the trade war, it looked like tough times ahead for China. The reality has been very different.

- Retail sales growth climbed to 4.3% in October, up from 3.3% in September, its third straight month of expansion

- Starbucks is making its largest ever investment outside the US in Chinese expansion.

- Internet and technology companies have moved rapidly to become the largest weighting in the Chinese stock market

For a moment there, it looked like the Covid-19 outbreak was going to be bad for China. It seemed inevitable that companies would move their supply chains away from the country that had launched a pandemic on the world and consumers would be deterred from buying Chinese goods. Geopolitical tensions would also cramp China’s style. Not so, apparently.

A slew of economic data from China this week showed that it is recovering nicely from the pandemic. In particular, retail sales growth climbed to 4.3% in October, up from 3.3% in September, its third straight month of expansion. Industrial output rose 6.9% from a year earlier, with its auto industry in rude health. Its early and co-ordinated response to the virus has helped it recover far faster than any other major region.

Equally, international investors appear not to have been deterred by China’s role in the pandemic. Starbucks, for example, is making its largest ever investment outside the US. Yes, some supply chains have moved elsewhere, but this was always likely given the rise in manufacturing costs in China. Given the shift in China’s economy, the shift doesn’t appear to be having a significant impact on China’s industrial production.

It is tempting to see supply chains as one way – Asia making widgets for the West. However, the pandemic has also forced Asian companies to source production closer to home. At the margins, this has helped Chinese companies become more efficient.

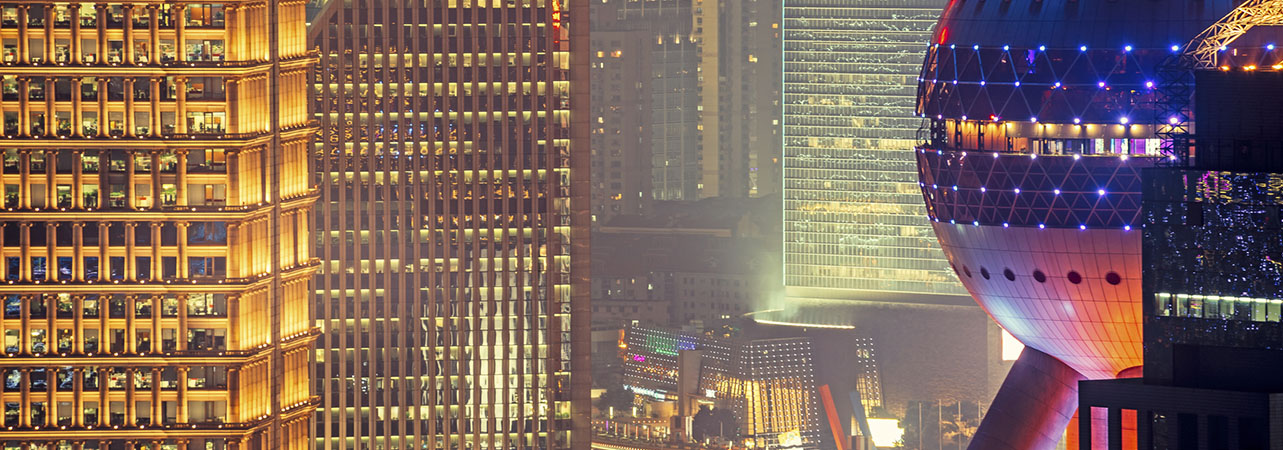

China is also at the forefront of many global trends. Internet and technology companies have moved to become the largest weighting in the Chinese stock market from a near-standing start 10 years ago. It also leads in areas such as biotechnology and green energy. Investors who want access to these trends have little choice but to look East.

Certainly, there are still risks: China has been in a benign period, where Western economies have allowed it free access to their markets and, by extension, their intellectual property. China has somewhat abused this privilege and it is unlikely that Western powers will be as generous in future. Most are already becoming more protective, with the US leading the way. Nevertheless, China’s huge domestic market should compensate to some extent.

Investors are now discussing China separating from a generalised ‘emerging market’ bucket. This may help flows into the region. Either way, the prospects for China have notably shifted from the start of this year when it was at the epicentre of a global pandemic. Predictions that China may dominate the 21st century in much the same way the US dominated the 20th century appear to be well-founded.