While factor return products are becoming more and more popular, investors may be interested if factor returns are higher in certain regions than others. This month, we investigate the size of factor premiums across regions and discover that they have been higher across some regions than others. In particular, the factor premiums available in the North American market have declined over the last 10 years. We then discuss likely reasons for the patterns and suggest how investors could respond.

Key issues this month:

- The quality factor has been the best performing factor on a global basis.

- Factor premiums have generally dropped across all regions in the last 10 years, but the exception to this is Japan.

- The North American market underwent the biggest decline in factor premiums and only the quality factor provided a decent return over the last 10 years.

“We examined 4 well-known factor premiums across 5 global regions and found that the Asian and European regions provided the strongest factor returns.”

Factor Risk & Returns

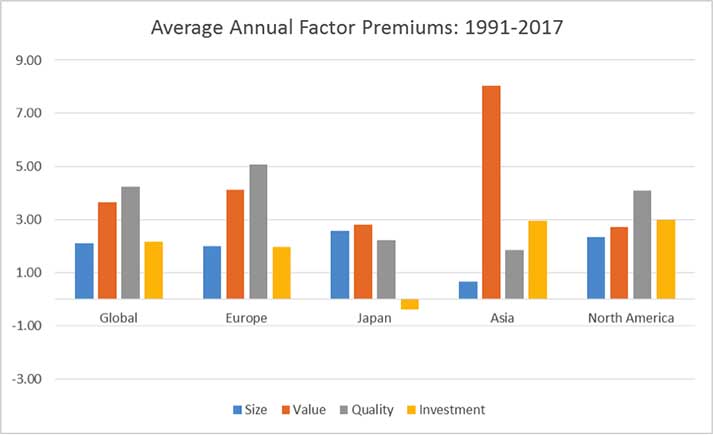

The chart below shows factor premiums for 5 different regions: Global, Europe including the UK, Japan, Asia (Hong Kong, Singapore, Australia, New Zealand) and North America. We focus in on four major factors: size, value, quality and low investment. The factor premiums are calculated by subtracting the returns of the top third of stocks, sorted by the factor, minus the bottom third. For example, the size factor is calculated as the return of the smallest third of stocks minus the return of the largest third of stocks.

Figure 1: Data taken from Ken R French Data Library

Looking first at the global region, all four of the factors had positive returns but the highest returns came from the quality factor, followed by value. The size and investment factors provided smaller, but still positive returns over the sample period. Within Europe, the quality and value factors provided high returns, with size and investment still providing decent positive returns. The next two regions, Japan and Asia, provided a less balanced picture. Japan had moderate factor returns in size, value and quality premiums, but negative in the investment premium. The distribution of factor returns has been skewed in Asia, with a large value premium and smaller premium to the other factors. The North American market provides the most balanced profile of factor returns, with a solidly positive factor premium for all four factors.

In terms of which region provided the best overall factor returns, Asia provided an average factor premium of 3.4% due to the large return provided by the value factor. The European market also provided a solid average factor return of 3.3% across the four factors. In the next section, we examine how the factor returns have held up over the last decade.

The Last 10 Years

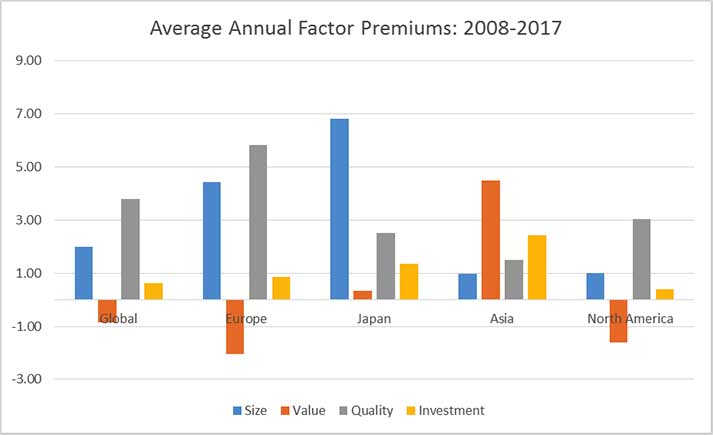

The chart below shows the same five regions and four-factor returns premiums, only now we examine data for the last 10 years only. This time period has seen the growth of many factor products that may influence the returns available.

Figure 2: Data taken from Ken R French Data Library

Global factor premiums were far lower over the last 10 years, with the value premium negative and investment premium only slightly positive. The only factor premium to hold up well in a global setting was quality and even this had a smaller premium than previously. The average factor premium was also lower in Europe, although this was somewhat disguised by high premiums to the quality and size factors, but a negative premium to the value factor. Japan was the only region that had a higher average factor premium over the last 10 years. This was largely down to a very large premium for the size factor. Average factors premiums across Asia were down slightly, although it retained a positive premium for the value factor. Finally, the North American region had a large fall in factor premiums with the value factor providing a negative return, although the return of the quality factor was still strong.

In summary, there was a decline in factor premiums across all regions, with Japan being a notable exception. North America was the region that underwent the biggest decline in factor premiums. At the factor level, the value and investment factors saw a large reduction in premiums over the last 10 years, while the quality and size factor premiums were preserved.

Conclusion

Investors may be interested in which regions a factor investing approach has performed the best. We examined 4 well-known factor premiums across 5 global regions and found that the Asian and European regions provided the strongest factor returns. The North American region initially provided good factor returns, but performance declined in the last 10 years. This may be due to the growth of factor investing products in the North American market and suggests that investors may be wise to target other regions. In terms of the factor premiums themselves, the quality factor was the best performer, both in the overall period and over the last 10 years. As quality is a less well-known factor than the others, it suggests that factor investors may do well by targeting the more esoteric factors.

Chris Riley, RSMR, November 2018