Smart beta and factor return strategies tend to invest in the liquid, large-cap segment of the market, ensuring that the products are scalable. The downside to this strategy is that large caps receive more attention from investors and may be more efficiently priced, which could reduce factor returns in this segment of the market. In this month’s article, we look at whether factor returns are smaller in the large-cap segment of the market. We find the factor returns are indeed smaller across large-caps and that risk is not necessarily lower across the large-cap factor portfolios. The evidence suggests that small-cap factor portfolios are optimal where market neutral factor exposure is required.

Key issues this month:

- Factor returns have been higher in the small-cap segment of the market across all factors.

- The evidence is mixed regarding the risk of factor returns. For some factors, volatility is higher across small-caps but not for others.

- The momentum factor within small-caps offers the highest factor return but also the highest risk.

“The evidence suggests that factor returns are higher across all factors in the small-cap segment of the market.”

Return Analysis

We first examine if the returns of factors are greater in large-caps or small-caps. To achieve this, we split the investment universe of US stocks into thirds based on market capitalisation. The top third of stocks, with the greatest market capitalisation, go into our large category. The stocks with the smallest market capitalisation go into our small category. We then segment factor returns into the large and small categories. The four factors that we examine are provided in a market neutral form, with no market exposure, and are defined below:

Value: The return of the cheapest half of stocks with the highest book-to-market ratio, minus the return of the most expensive half of stocks.

Quality: The return of the top half of stock sorted by operating profitability, minus the return of the lowest quality half of stocks.

Investment: The return of the top half of stocks with the lowest change in total assets over the fiscal year, minus the return of the highest investment half of stocks.

Momentum: The return of the top half of stocks with the highest momentum, measured as the percentage increase in share price over the last year (excluding the latest month), minus the return of the bottom half of stocks with the lowest momentum over the last year.

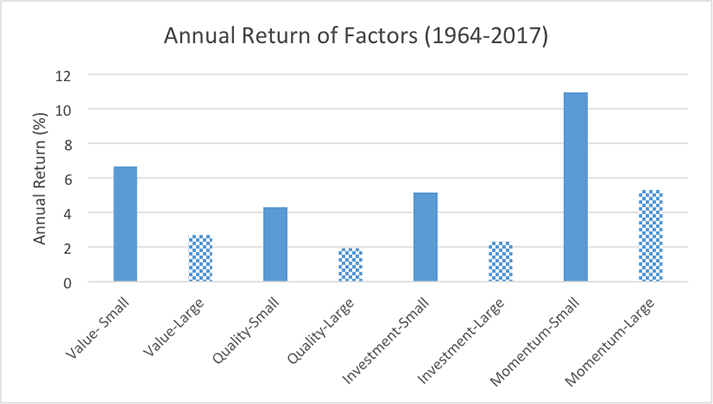

The chart below shows the annual factor returns for US stocks across the 1964-2017 period. For each factor we show the returns for both the small stocks, represented by a solid line, and the large stocks, represented by a patterned line.

Figure 1: Data taken from Ken R French Data Library

A few features of the chart are striking. The first is that for all four factors, the annual returns have been higher for small stocks than for large stocks. The second feature of note is the very large returns available for the momentum factor within small caps, which dwarfs the returns of the other factors. In summary, the evidence suggests that factors returns are indeed greater for small-caps than for large-caps and this is consistent across all four factors. One objection to the analysis could be that small-caps are riskier to invest in and so we examine the volatility of small-cap and large-cap factor returns in the next sector.

Risk Analysis

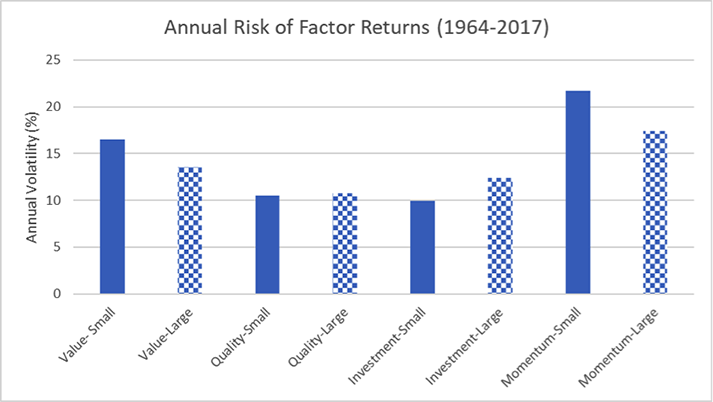

The chart below shows the volatility of annual returns for the four factors. Small-cap returns are again represented by the solid line, with large caps represented by the patterned line.

Figure 2: Data taken from Ken R French Data Library

In the case of value and momentum, large-cap returns are less volatile than small-caps. This picture is reversed, however, for the quality and investment factors. It is also worth noting that the high returns for small-cap momentum stocks do come with higher risk, with annual volatility over 20%. In summary, there is no clear evidence that the risk of market neutral small-cap factors is any higher than that of large-cap factor returns.

Conclusion

Commercial smart beta and factor portfolios tend to invest in the large-cap segment of the market. We have examined factor returns and risk across the small-cap and large-cap segments of the market. The evidence suggests that factor returns are higher across all factors in the small-cap segment of the market. In terms of risk, there is no firm evidence that small-cap or large-cap factor portfolios are riskier. The implication of the analysis is that when investors are targeting market neutral factor returns, the historical evidence suggests it would be optimal to choose products that target the small-cap segments of the market.

Chris Riley, RSMR, June 2018