The low volatility factor is becoming more popular as investors look for a potential safe haven in troubled markets, but has the low volatility factor provided protection in previous market crashes? This month, we examine the performance of the low volatility factor during the previous two market cycles to see if it provided any protection for investors. We find that low volatility has indeed provided good protection during market corrections, although it performs poorly in subsequent rebounds.

Key issues this month:

- High volatility stocks performed extremely poorly during the 2008 crash and were down by over 70% at the bottom.

- Low volatility stocks provided protection during 2008, as they were down only 27% over the same period.

- Low volatility has provided similar levels of protection in all prior downturns since 1970.

The 2008 Downturn

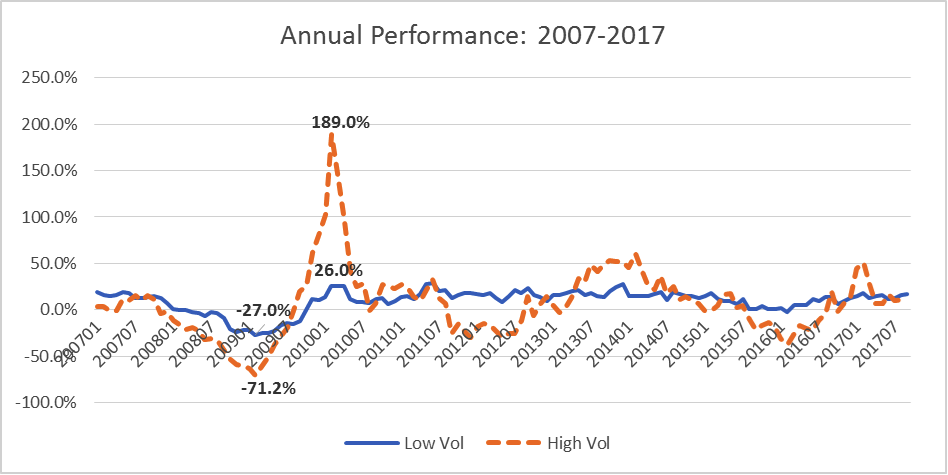

The first period that we shall examine is the 2008 crash and rebound. The chart below shows the annual performance of a portfolio of either low volatility stocks or high volatility stocks. Data is from the US share market and portfolios are formed by splitting the universe into deciles. The decile of stocks with the lowest annual volatility is represented by the blue line, while the decile of stocks with the highest volatility is represented by the orange, dashed line.

Figure 1: Data taken from Ken R French Data Library

Both the low volatility and high volatility portfolios bottomed out in early 2009, but there was a big deviation in performance. While the low volatility portfolio performed relatively well and was only down 27% at the very bottom, the high volatility portfolio was down over 70% over the same period. In short, there is no doubt that low volatility provided protection during the 2008 crash.

What about the performance subsequent to the crash? The high volatility portfolio performed very strongly in the 2010 rebound and was up nearly 190%. This rebound was sufficient to make back most of the previous fall. The low volatility portfolio performed substantially worse, as it was only up 26% over the same period. In summary, both high and low volatility portfolios rebounded in 2010 and made back most of their previous losses with high volatility portfolio having both the biggest fall and biggest subsequent rebound.

Pre-2007

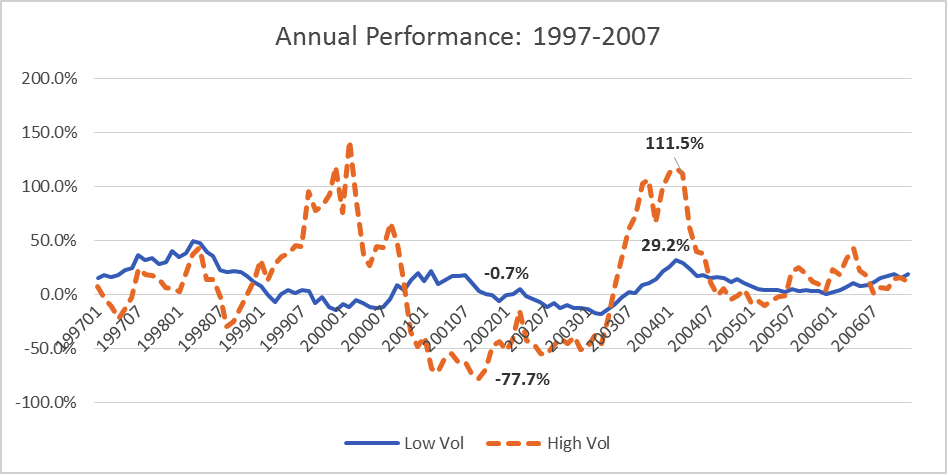

The chart below shows the performance for low and high volatility stocks in the 10 years prior to the previous chart. This period includes the tech stock boom & bust, which is another useful market cycle over which to examine the performance of the low volatility portfolio.

Figure 2: Data taken from Ken R French Data Library

The high volatility stocks were down a similar amount in this crash as they were in 2008, hitting an annual low of -78%. Over the same time period, the performance of low volatility stocks was flat, although they did drift down lower over the subsequent year.

In terms of the recovery, we again witnessed a very impressive bounce back for high volatility stocks of 112%. The recovery of low volatility stocks was far more modest at only 29%. The recovery period for both high volatility and low volatility stocks is again very similar to the 2008 cycle.

Conclusion

Low volatility stocks have provided impressive protection in both the 2000 and 2008 crashes and would have delivered a measure of capital protection for investors. Conversely, they did not provide very good performance in subsequent recovery periods and were comprehensively outperformed by more speculative, high volatility stocks. Looking back at all market crashes post-1970 has produced a similar pattern of performance, with low volatility stocks providing protection during downturns.

Although low volatility stocks provide some measure of protection during a downturn, the best strategy for an investor is not to be invested in the equity market during these periods. The main issue with this strategy is that it is difficult to forecast market crashes. For investors who wish to remain fully invested in the market, low volatility stocks have provided a far smoother ride during crashes and subsequent recoveries than the general market.

Chris Riley, RSMR

November 2017