Investors will be aware that the current 10-year bull-run within the stock market is one of the longest in history. This period of positive performance has coincided with growth in western economies that has not been interrupted a recession. This month, we examine the relationship between the stock market and the economy, to explore if one is forecastable by the other.

We find that stock market dips and recessions are closely linked together and that stock market dips tend to lead ahead of recessions. In addition, we show that stock market recoveries also begin several months before a recession ends.

Key issues this month:

- Four out of five of the major stock market corrections since 1980 have coincided with economic recessions.

- Stock market corrections usually begin an average of 10 months before the start of the recession.

- Stock market corrections typically end before a recession by a period of around 4 months on average.

“In terms of starting dates, stock market corrections typically begin around 10 months before a recession.”

The Economy and the Stock Market

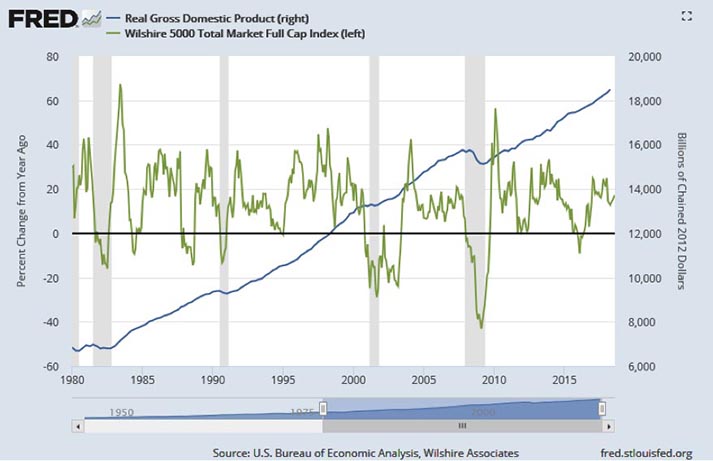

The following graph shows US real GDP and stock market performance for the 1980-2018 period. The blue line shows real GDP in absolute terms, while the green line represents the annual performance of the Wilshire 5000 index.

Figure 1: Graph showing (Source- Fred Database)

The US economy grew steadily over the period represented by the rising blue line, but this growth was interrupted by a total of 4 recessions. The recessions are represented by the shaded grey bars, with the longest being the most recent recession in the 2008-2009 period. Turning to the performance of the equity market, there are a total of 5 instances where performance dips into negative territory. In 4 out of 5 cases, these dips coincide with recession periods but in one case, in the late 1980’s, the stock market index exhibits negative annual performance without a recession.

Turning now to stock market performance during the recessions, it appears from the graph that stock market dips tend to begin at the start or somewhat before the start of a recession in all 4 cases. It is also the case that the stock market appears to recovery at or just before the end of the recessions. To explore in more detail, we next examine the data in tabular format below.

The following table shows the 4 recession periods and 5 stock market corrections in tabular form. The start and end dates for the recessions and stock market drops are shown in the respective columns, along with the length of each event in months. The time lag columns represent the difference in months between the stock market drop and the recession period. For example, a -3 lag shows that the stock market correction began 3 months before the recession.

Table 1: Showing Dates of Recessions and Stock Market Corrections for US Market: 1980-2018

In terms of length, the corrections have been around the same length as recessions, with a slight bias towards them lasting a few months longer. The time lag columns tell us how many months the correction began and end before the recession. In terms of starting dates, stock market corrections typically begin around 10 months before a recession. The lead time was particularly long in the March 2001 recession, which followed a collapse in tech stocks 19 months before the recession in the economy occurred. The ending time of recessions and corrections is normally far more closely aligned. A stock market correction normally ends around 4 months before the recession ends. In summary, although stock market corrections are closely aligned with the economy, they typically start around 10 months before a recession starts and end around 4 months before a recession ends.

Conclusion

We examined the history of stock market corrections and recessions since 1980 and showed that there have been 5 major corrections and 4 recessions. Typically, stock market corrections are closely aligned with recessions, but they tend to start earlier than a recession and end just before the recession ends on average.

For investors looking to time the market, economic indicators such as the shape of the yield curve, are an important flag for an impending recession. Even if the recession itself has some predictability, however, the investor should be aware that stock market corrections normally begin well ahead of any recession. In terms of timing re-entry into the market, some bravery is needed, as the stock market recovery normally begins while a recession is still in place.

Chris Riley, RSMR, August 2018