Having scrapped its GDP target last May in response to the Covid-19 pandemic, China announced that it aims to achieve economic growth in excess of 6% in 2021. Although the country expanded by a relatively muted 2.3% in 2020, China was the only major economy to achieve positive economic growth during the year.

- Exports surged in China

- Inflationary pressures intensified in Brazil

- Brazil’s economy shrank by 4.1% in 2020

To view the series of market updates through March, click here

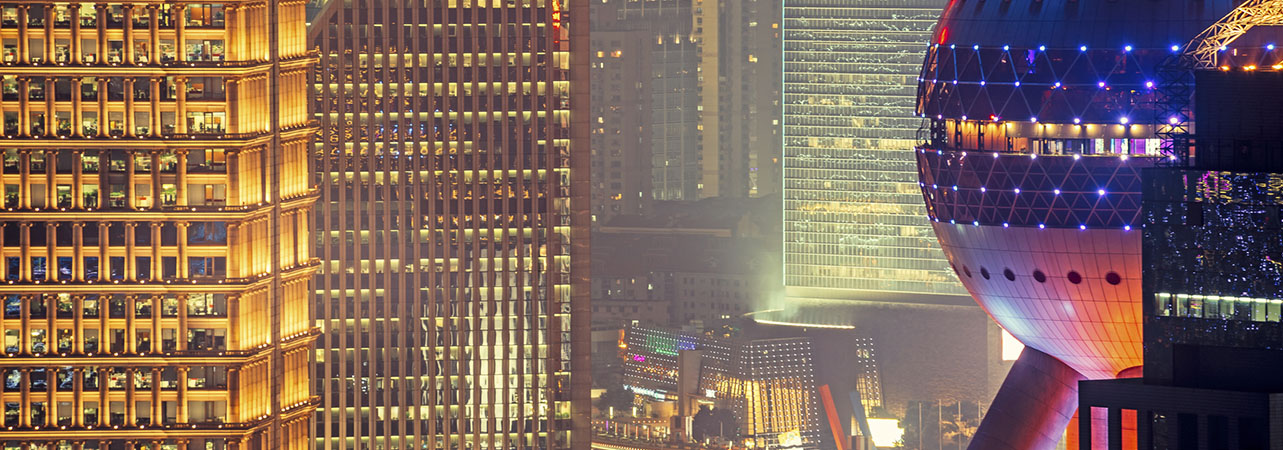

Having scrapped its GDP target last May in response to the Covid-19 pandemic, China announced that it aims to achieve economic growth in excess of 6% in 2021. Although the country expanded by a relatively muted 2.3% in 2020, China was the only major economy to achieve positive economic growth during the year. The target was announced by Premier Li Keqiang at the annual National People’s Congress, and the government intends to concentrate its efforts on “reform, innovation, and high-quality development”. Nevertheless, the target appears somewhat conservative in comparison to the International Monetary Fund’s (IMF’s) forecast of 8.1% growth and the Organisation for Economic Cooperation & Development’s (OECD’s) prediction of 7.8%.

“Brazil’s central bank increased its key interest rate for the first time since July 2015”

China’s exports surged at an annualised rate of 60.6% in US dollar terms over the first two months of 2021, although this is in comparison to the same period last year, during which trade was badly hit by the onset of the coronavirus pandemic. Imports rose by 22.2%. The Shanghai Composite Index fell by 1.9% over March.

Share prices in Brazil were volatile during March as a fresh wave of Covid-19 infections swept the country; nevertheless, the Bovespa Index rose by 6% over the month as a whole. In a bid to dampen inflationary pressures, Brazil’s central bank increased its key interest rate for the first time since July 2015, when it hit 14.25%. Policymakers raised the Selic rate by 0.75 percentage points to 2.75% and indicated that further tightening could take place at the Copom’s next meeting in May. The rate of consumer price inflation surged to 0.93% during March, compared with February’s rate of 0.48%, reaching its highest rate for the month of March since 2015, when it hit 1.24%. On an annualised basis, inflation climbed from 4.57% to 5.52% – well ahead of the central bank’s target of 3.75% with a tolerance band of 1.5 percentage points on either side.

Brazil’s economy contracted by 4.1% over 2020, posting its largest decline in more than 25 years as the Covid-19 pandemic undermined activity. Imports dropped by 10%, while exports fell by 1.8% and household consumption declined by 5.5%. The agricultural sector was the only sector to register growth during the year, expanding by 2%; in contrast, industrial output declined by 3.5%, while the services sector shrank by 4.5%.

A version of this and other market briefings are available to use in our newsletter builder feature. Click here