China’s economy continued to rebound from the impact of the Covid-19 pandemic. Having contracted at an annualised rate of 6.8% during the first three months of 2020, it grew by 3.2% in the second quarter and, during October, reported third-quarter expansion of 4.9%.

To view the series of market updates through October, click here

- China’s export activity continued to grow

- Inflationary pressures intensified in Brazil

- India announced further economic stimulus measures

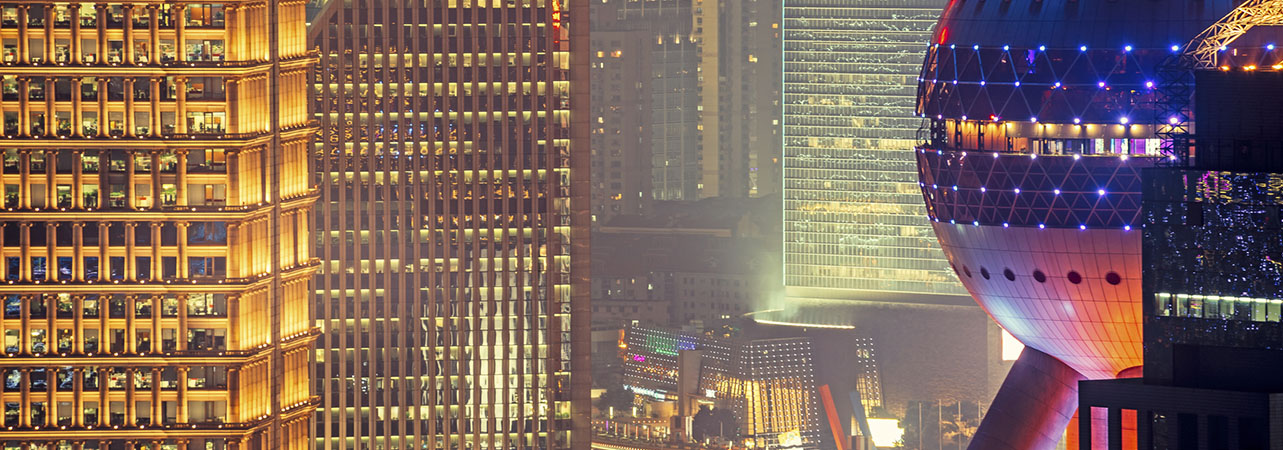

China’s economy continued to rebound from the impact of the Covid-19 pandemic. Having contracted at an annualised rate of 6.8% during the first three months of 2020, it grew by 3.2% in the second quarter and, during October, reported third-quarter expansion of 4.9%. The International Monetary Fund (IMF) described China’s economic recovery as “a rare positive figure in a sea of negatives”. During October, the country’s Premier, Li Keqiang, emphasised the need to consolidate the momentum for a steady recovery, and called on China’s business leaders to explore new business models and continue to develop new drivers for growth. Meanwhile, China’s export activity continued to improve during September, increasing by 9.9% year on year, while imports rose at an annualised rate of 13.2%. The benchmark Shanghai Composite Index edged up by 0.2% over October.

“A rare positive figure in sea of negatives” (IMF on China)

Consumer price inflation in Brazil rose by 0.64% during September, posting its strongest month-on-month increase for September since 2003. The rate of inflation was driven up by higher prices for food and fuel. On an annualised basis, inflation climbed by 3.14%, but remained below the central bank’s target rate of 4%, reassuring investors that monetary tightening is unlikely to be imminent.

The central bank’s key Selic interest rate remained unchanged at an all-time low of 2% in October. In a statement, officials said that Brazil is experiencing an “uneven” economic recovery, reiterating that expectations for inflation remain “significantly” below target and that the recent increase in inflation, caused by higher fuel and food prices and “persistent exchange rate depreciation”, is only temporary. Looking ahead, the central bank expects the Selic rate to rise to 2.75% next year, rising to 4.5% in 2022. The Bovespa Index fell by 0.7% during October.

The World Bank sharply downgraded its outlook for economic growth in India for the current fiscal year, cutting its forecast to -9.6%. The World Bank cited the impact of lockdown measures caused by the coronavirus pandemic, and the “income shock” suffered by households and companies. India’s economy is expected to recover to achieve growth of 5.4% in the following fiscal year. Elsewhere, during October, India’s Finance Ministry announced economic stimulus measures designed to shore up domestic demand against a backdrop of slowing consumer spending caused by the pandemic. The CNX Nifty Index rose by 3.5% over the month.