Investor sentiment was lifted during December by the news that the US and China had reached a preliminary “Phase One” trade agreement in its long-running trade war. The news was well received not only in China and the US, but also in many other countries that have been affected – directly or indirectly – by the conflict.

- China’s manufacturing activity picked up in December

- Brazil’s central bank cut the key Selic rate to 4.5%

- Food-price inflation surged in India

To view the series of market updates through December, click here

Investor sentiment was lifted during December by the news that the US and China had reached a preliminary “Phase One” trade agreement in its long-running trade war. The US will reduce or postpone existing tariffs on Chinese imports, while China intends to reduce tariffs for all its trading partners on 859 products, and will cut tariffs on over 8,000 other products. The news was well received not only in China and the US, but also in many other countries that have been affected – directly or indirectly – by the conflict.

“The US will reduce or postpone existing tariffs on Chinese imports”

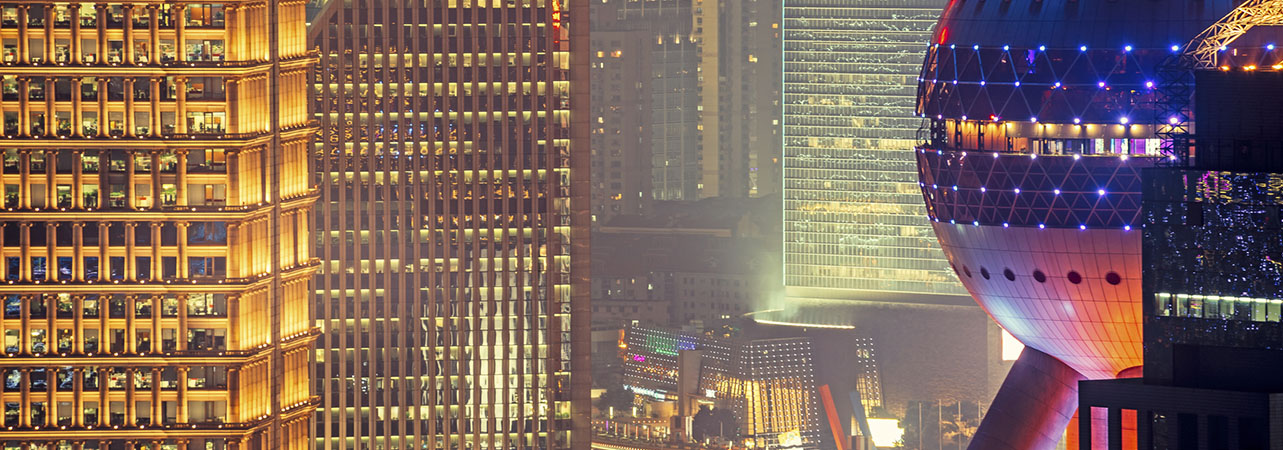

China’s exports fell at an annualised rate of 1.1% during November and shipments to the US dropped by 23.3% as the trade conflict between the two countries continued to take its toll. Meanwhile, imports rose by 0.3% year on year. However, following the news of the “Phase One” trade deal, China’s manufacturing activity strengthened in December as relations between the US and China began to show some signs of improvement. Elsewhere, profits at industrial companies picked up in November, rising by 4.4% year on year, and retail sales rallied in November, posting their fastest growth since June. The Shanghai Composite Index rose sharply following the trade deal’s announcement and ended December 6.2% higher. Over 2019 as a whole, the benchmark index rose by 22.3%.

In a bid to support economic growth, policymakers at Brazil’s central bank voted unanimously to cut its key Selic rate from 5% to 4.5% during December against a backdrop of benign inflation. The Selic rate was as high as 14.25% in 2016. Brazil’s central bank upgraded its economic growth forecast for 2020 from 1.8% to 2.2%, although this improvement will depend on further advances in economic reforms. Inflation is expected to reach 3.5% in 2020 and 3.4% in 2021. Looking ahead, the central bank expects its approach to monetary policy to remain cautious. The Bovespa Index rose by 6.8% during December and by 31.6% during the year.

India’s industrial production maintained its contraction into October, shrinking at an annualised rate of 3.8%. Annualised growth in inflation continued to rise in November, climbing from 4.62% in October to 5.54% and driven up by sharp increases in food prices, which surged by more than 10%. The CNX Nifty Index rose by 0.9% in December and by 12% over 2019 as a whole.

A version of this and other market briefings are available to use in our newsletter builder feature. Click here