Passive investing provides little protection in the event of a market downturn, as no active positioning is allowed. This means that many passive investors will wish to monitor market development closely for any signs of an upcoming recession. This month, we examine two leading indicators that have clear links with previous recessions: the corporate profit margin and total vehicle sales. We analyse both indicators and show that neither one of them suggest that a recession is imminent.

Key issues this month:

- Corporate profit margins have been a strong leading indicator of 2 of the last 4 recessions and a weaker indicator of the other 2.

- Total vehicle sales have been a strong leading indicator of 3 out of the last 4 recessions.

- Neither leading indicator suggests that a recession is imminent in the US, although profit margins are on the decline.

Corporate Profit Margins

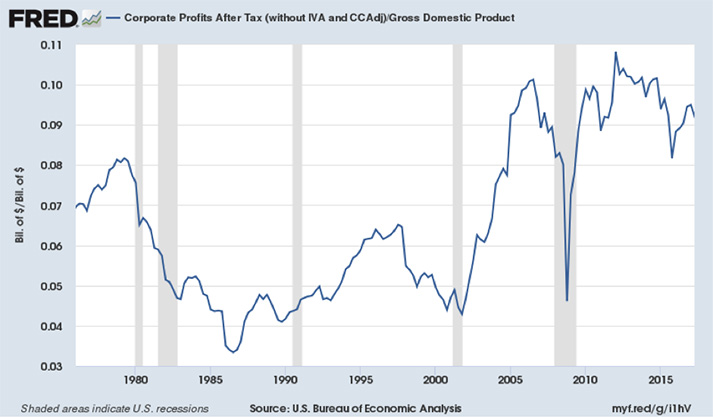

The graph below shows US corporate profit margins as a percentage of GDP, which represents the share of company profits as a percentage of the whole economy. The data begins in January 1976 until the present time. There are 4 recessions in the graph (counting the double dip in the early 80’s as a single recession), represented by the shaded grey bars.

Figure 1: Retrieved from FRED, Federal Reserve Bank of St. Louis: https://fred.stlouisfed.org/series/CP, February 1, 2018

A peak in the corporate profit margin has preceded all 4 previous recessions making it a leading indicator. The strongest relationship between the profit margin and recessions was provided by the 1980 and 2008 recessions. These recessions began after 2-4 quarters of a decline in profit margins. The peak in profits margins in the early 90s and early 2000s came a few years earlier than the recessions, however.

"Neither of the two leading economic indicators are suggesting an imminent recession."

Looking at current profit margins, although a peak appears to have been reached in Q1 of 2012, we haven’t seen a plunge in profits margins of the scale that has previously triggered a recession, but rather a gradual move downward. In summary, the profit margin is not yet flagging a recession warning although it needs to be monitored closely as it is on a downward trend.

Vehicle Sales

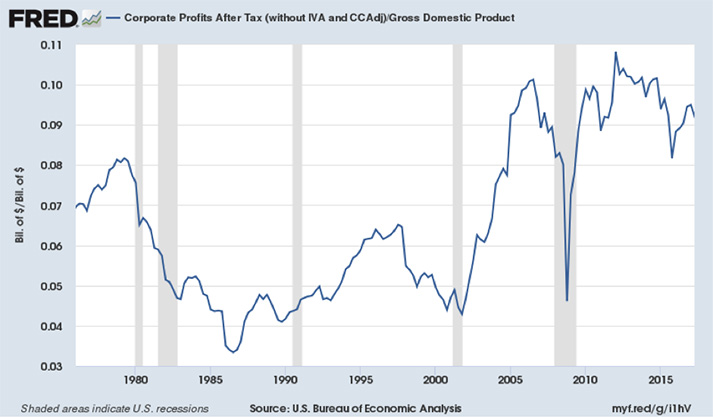

Another leading economic indicator is US domestic vehicle sales. The chart below shows the total number of annual vehicle sales, expressed in millions over 1976 to the present time. Recessions are again reflected by the grey bars.

Figure 2: Retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TOTALSA, January 31, 2018

Total vehicle sales have been a good leading indicator of the recessions in the early 80s, 90s and 2008. There is typically a peak a couple of years before the recession and then a rapid decline leading into the recession. The link with the recession in 2000 is more strained although car sales did peak about a year ahead of this recession.

Looking at the current situation, car sales appear to have peaked in late 2017. This is not necessarily a cause for concern as we have not seen a major decline yet in car sales that typically lead into a recession and car sales could pick up again following the recent tax reforms in the US. In summary, total vehicle sales do not appear to be flagging an imminent recession.

Conclusion

Passive investing is sensitive to market conditions, as it provides no downside protection in the event of a market crash. This presents a difficulty in that market timing is incredibly difficult to do well. In this article, we have discussed two leading indicators that have done a good job of predicting previous recessions.

Neither of the two leading economic indicators are suggesting an imminent recession. The most concerning is the profit margin graph, which suggests that profit margins peaked a few years ago. This isn’t necessarily a cause for imminent alarm, however, as profit margins have remained high over recent years. Total vehicle sales remain steady and have not yet undergone a rapid decline that typically precedes a recession.

-

Chris Riley

RSMR

February 2018