April 2018

China posted encouraging annualised economic growth of 6.8% during the first three months of the year, beating the official target of “around 6.5%”. Nevertheless, there are persistent concerns about mounting debt levels in China. During April, the IMF warned China against financing unsustainable infrastructure projects in highly indebted countries.

- Brazil’s inflation rate remained below-target

- Brent crude oil rose above US$75pb

- Reserve Bank of India held interest rates at 6%

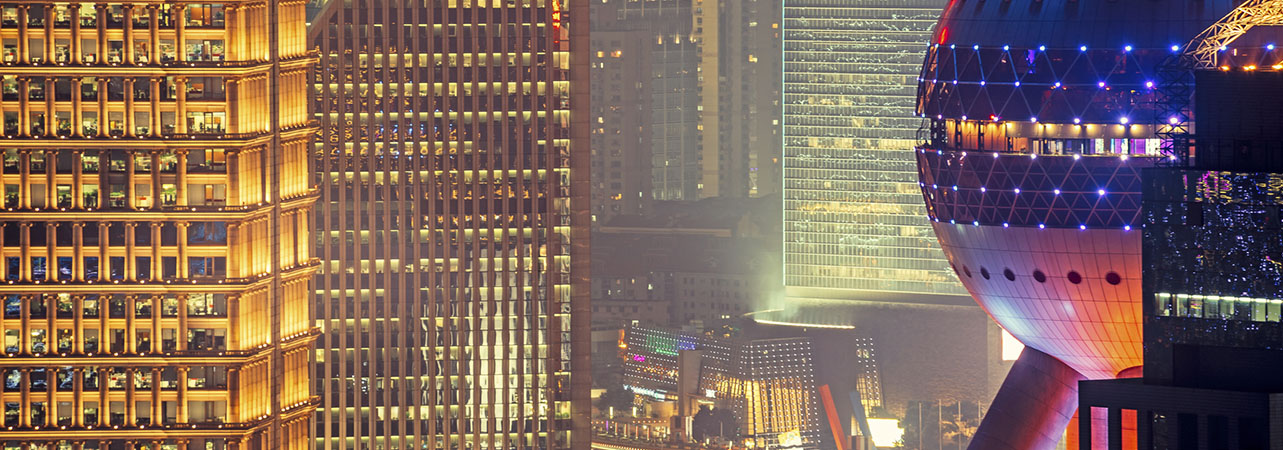

China posted encouraging annualised economic growth of 6.8% during the first three months of the year, beating the official target of “around 6.5%” set at March’s National People’s Congress. Nevertheless, there are persistent concerns about mounting debt levels in China. During April, the International Monetary Fund (IMF) cautioned China against financing unsustainable infrastructure projects in highly indebted countries, warning that such ventures could “lead to a problematic increase in debt, potentially limiting other spending … and creating balance of payments challenges”. The Shanghai Composite Index fell by 2.7% over the month.

“The oil price continued its climb in April, rising to its highest level since 2014”

Sentiment in Brazil was dampened by news of lacklustre economic activity. According to the central bank’s index of economic activity, activity edged up at a monthly rate of only 0.09% during February, boosting expectation of further reductions in interest rates. Policymakers began cutting rates in October 2016, when the Selic rate was 14.25%. Since then, the Copom has implemented 11 further cuts, reducing the Selic rate to its current level of 6.5%. Looking ahead, the central bank is widely expected to implement another cut in the near future unless the rate of inflation picks up. Brazil’s annualised rate of inflation declined to 2.68% during March, which was below the floor of the central bank’s target rate of 4.5% plus or minus 1.5 percentage points. The Bovespa Index rose by 0.9%.

The World Bank expects India’s economy to expand by 7.3% this year and 7.5% next year, underpinned by a “sustained recovery” in private consumption and private investment. The World Bank also highlighted the challenges faced by South Asian countries in maintaining employment levels as workforces continue to expand. India’s rate of inflation eased from 5.1% in January to 4.4% during February, constrained by lower prices for food and fuel. The CNX Nifty Index rose by 6.2%.

The Reserve Bank of India (RBI) maintained its key interest rate at 6% during April, citing “uncertainties surrounding the baseline inflation path” including fiscal budget slippage and volatility in the price of oil. The oil price continued its climb in April, rising to its highest level since 2014 and driven up by an ongoing reduction in supply and by concerns over geopolitical issues, particularly with regard to the possibility of new sanctions on Iran. The price of a barrel of Brent Crude oil rose above US$75 during the month.

A version of this and other market briefings are available to use in our newsletter builder feature. Click here