Ben Lofthouse of Henderson Global Investors explains why bigger does not necessarily mean better when it comes to investing in global equity income

History shows that dividends from the highest-yielding stocks are often unsustainable. We believe the best approach is to invest across a diversified list of moderate-paying companies that offer scope for both dividend and capital growth over the medium-to-long term.

- High-yielding equities can be more risky than their lower-yielding peers, so we believe in avoiding “value traps”

- On closer examination, high-yielding companies can turn out to have structurally challenging businesses or unsustainable payout ratios

- We believe that an active, stock picking approach allows fund managers to identify undervalued higher-yielding companies

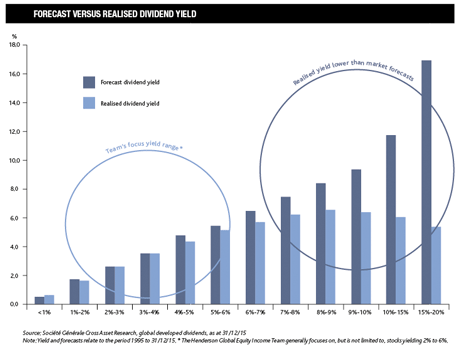

The chart below, is one of the reasons we believe that investing across a diversified list of moderate-paying companies that have the potential to offer both dividend and capital growth over the medium to long term is the best approach.

Yield reflects how much a company has paid out in dividends - that is to say, income - in the course of the last year, relative to its current share price. As yield is a function of price, if a company’s share price falls in value then its yield (relative to its price) will rise. Alternatively, if its share price rises then its dividend yield relative to the current share price will fall.

The chart to the right looks at the sustainability of dividend yields across developed markets between 1995 and December 2015 and highlights the risk of chasing high yields without considering the underlying strength of the company. It shows that, in general, an estimated yield above 6% is less likely to be realised – as can be seen by the difference between the darker and lighter blue bars – than a forecast yield of 6% or below.

"With more than 1,300 stocks in the MSCI All Country World index currently yielding 2% or more, there are still plenty of opportunities for global equity income investors."

Avoid the value traps

We believe in avoiding so-called ‘value traps’ – stocks that are cheap and for a good reason – because high-yielding equities can be more risky than their lower-yielding counterparts, and particularly after a period of strong market performance since equity price rises push yields down. The high-yielding companies that are left are often structurally-challenged businesses or companies with high pay-out ratios – those that distribute a high percentage of their earnings as dividends – which may not be sustainable.

An investor simply focusing on yields, or gaining exposure to this area of the market through a passive product, such as a high-yield index tracker fund, may end up owning a disproportionate percentage of these value traps. We believe that an active, stockpicking approach is essential to equity income investing because it allows fund managers to analyse and understand which higher-yielding companies may have been undervalued by the market. To establish whether there is a real value opportunity, we analyse a company’s earnings, strategy and the industry fundamentals to determine whether it is structurally at risk or whether it is just temporarily unloved, undervalued or its earnings power underappreciated by the market.

Growing cash generation

Investors using a barbell investment approach – that is, holding very high-yield stocks to deliver income and very low dividend payers with more growth potential – may end up facing a greater than average number of dividend cuts than they appreciate. We prefer to spread risk by having a diversified portfolio of moderate dividend payers. Our focus is on investing in companies with strong and growing cash generation with the aim of finding attractive capital and dividend growth.

With a universe of more than 1,300 stocks in the MSCI All Country World index currently yielding 2% or more, there are still plenty of opportunities for global equity income investors. We focus on dividend-paying companies that are generally yielding between 2% and 6%. This helps to ensure the yields we deliver to investors are at a healthy level and are suitably diversified with no reliance on any one sector or stock. This is in line with our philosophy of avoiding overvalued areas of the market.

Ben Lofthouse is co-manager of the Henderson Global Equity Income Fund