With the current economic cycle now 9 years old, investors are interested in strategies that can perform in the later part of the economic cycle. This month, we apply this question to the area of smart beta factors by exploring which factors have performed well and provided downside protection in late cycle environments. We show that momentum has provided good average performance and strong downside protection in such environments, while size and quality factors have provided poor average performance and weak downside protection. In the conclusion, we speculate as to why the factors may have performed as they have.

Key issues this month:

- The last 50 years has featured 6 periods of recession, with the early 1980’s featuring a double-dip recession.

- Price momentum has outperformed all the other factors in pre-recession periods and also provided greater downside protection.

- Size and quality factors provided the worst downside protection and average performance in pre-recession periods.

Defining Pre-Recession Periods

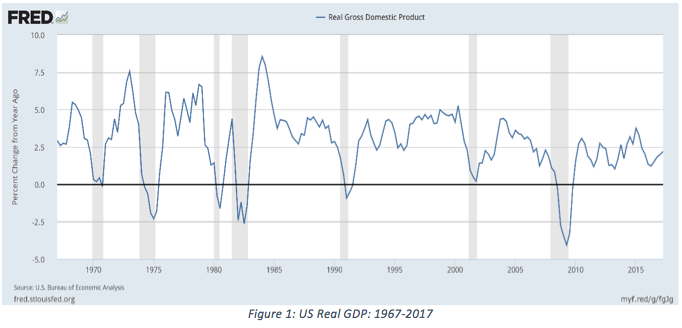

The first issue is to define and select the pre-recession periods. The chart below shows US real GDP over the last 50 years, with recessions indicated by the grey bars. From the chart, we can identify quarters beginning with a recession as follows: Q1 1970, Q1 1974, Q1 1980, Q3 1990, Q2 2001 and Q1 2008. We ignore the recession in 1982, as this was an unusual double-dip recession that was arguably a continuation of the recession that began in Q1 1980.

We then define the pre-recession period as 2 years prior to the quarters where the recession began. So for the Q1 1970 recession, we measure factor performance from Q1 1968 to Q4 1969 and repeat this for the other recession periods.

Factor Performance

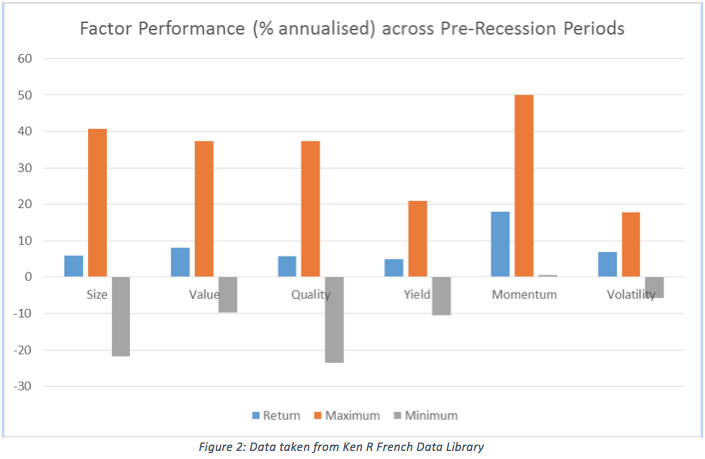

The chart below shows the average performance of 6 factors over the 6 pre-recession periods defined above. Factor performance is calculated using the top decile of stocks, screened by the relevant factor. We also show the best and worst pre-recession period performance for each factor, shown as maximum or minimum in the chart. All data is taken from the US stock market.

In terms of factor performance, the momentum factor has the highest average performance of around 18% per annum. All of the other factors have positive average performance over the pre-recession periods, which is not surprising as late-cycle is generally a strong time for equity markets. Aside from the value factor, which has average performance of around 8% per annum, all of the other factors have performance in the 5-6% range.

In terms of downside protection, reflected in the grey bar, momentum is the only factor that has positive performance across all 6 pre-recession periods. Momentum’s worse performance was 0.5%, achieved in the 1972-1973 period, with the other factors also doing extremely poorly over this period. Value, yield and volatility also provide reasonable downside protection across the 6 periods. Size and quality provide very poor downside protection in pre-recession periods, in addition to having low average returns.

Conclusion

With it being 9 years since the last recession, many commentators believe we are in the last phase of this current economic cycle. Given the popularity of factor strategies, it is useful to examine which factors actually perform well in such an environment and provide reasonable levels of downside protection on a historical basis.

There is no doubt that the momentum factor has provided the best performance and downside protection in previous pre-recession periods. It tends to do well because investors are looking for `hot stocks’ to invest their money in a market that tends to become more growth orientated, in the later stages. Momentum often performs poorly when the cycle changes, but is a strong factor in trending markets. Factors to avoid in late-cycle are size and quality, which seem to perform better in the earlier phase of the recovery.

Chris Riley

RSMR

October 2017